Exploring the realm of life insurance quotes, this introduction sets the stage for a detailed journey into the importance, factors, types, obtaining process, and understanding of life insurance premiums. It aims to provide valuable insights and information in a structured and engaging manner.

The following paragraphs will delve into the intricacies of life insurance quotes, shedding light on various aspects that are essential for making informed decisions.

Importance of Life Insurance Quote

Getting a life insurance quote is crucial for individuals looking to secure their financial future and protect their loved ones in the event of unexpected circumstances.

Benefits of Comparing Multiple Life Insurance Quotes

- Allows you to find the best coverage: By comparing quotes from different insurance providers, you can choose a policy that offers the most comprehensive coverage at an affordable price.

- Helps in saving money: Comparing multiple quotes ensures that you are not overpaying for your life insurance policy. You can find a plan that fits your budget without compromising on coverage.

- Provides peace of mind: Knowing that you have explored different options and selected the best life insurance policy for your needs can give you peace of mind knowing that your loved ones will be taken care of.

How a Life Insurance Quote Helps in Financial Planning

- Assists in determining the right coverage amount: By obtaining multiple quotes, you can assess how much coverage you need based on your financial obligations and future expenses.

- Aids in budgeting: Having a clear idea of the cost of different life insurance policies can help you budget effectively and ensure that you can afford the premiums without straining your finances.

- Facilitates long-term financial security: With the right life insurance policy in place, you can create a financial safety net for your loved ones, ensuring that they are financially protected even if you are no longer around.

Factors Affecting Life Insurance Quotes

When it comes to determining life insurance quotes, several key factors come into play. These factors can significantly impact the cost of premiums and the overall coverage offered. Understanding these factors can help individuals make informed decisions when purchasing life insurance.

Age and Health

Age and health are two critical factors that heavily influence life insurance quotes. Generally, younger individuals who are in good health are likely to receive lower premiums compared to older individuals or those with pre-existing health conditions. This is because younger and healthier individuals are considered lower risk by insurance companies, leading to more affordable rates.

As individuals age or face health challenges, the cost of life insurance coverage typically increases due to the higher perceived risk of mortality.

Lifestyle Choices

Apart from age and health, lifestyle choices also play a significant role in determining life insurance quotes. Factors such as smoking, excessive drinking, participation in high-risk activities, and poor dietary habits can impact insurance premiums. Individuals who engage in risky behaviors are viewed as higher risk by insurance providers, leading to higher premiums.

Making healthy lifestyle choices can not only improve overall well-being but also result in more affordable life insurance rates.

Types of Life Insurance Policies

Life insurance policies come in various forms, each serving different purposes and catering to diverse needs. Understanding the differences between these policies can help individuals make informed decisions when choosing the right coverage for themselves and their loved ones.

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to beneficiaries if the insured individual passes away during the term. On the other hand, whole life insurance provides coverage for the entire lifetime of the policyholder and includes a cash value component that grows over time.

While term life insurance is more affordable, whole life insurance offers lifelong protection and an investment component.

Universal Life Insurance and Variable Life Insurance

Universal life insurance is a flexible policy that allows policyholders to adjust their premium payments and death benefits. It also accumulates cash value over time, offering potential investment growth. Variable life insurance, on the other hand, allows policyholders to invest in sub-accounts similar to mutual funds, with the cash value dependent on the performance of these investments.

While universal life insurance provides flexibility, variable life insurance offers the opportunity for higher returns but also comes with higher risks.

Suitable Life Insurance Policies for Different Life Stages

Young Adults

Term life insurance may be suitable for young adults who are looking for affordable coverage to protect their loved ones in case of an untimely death.

Middle-Aged Adults

Whole life insurance can be a good option for middle-aged adults who want lifelong coverage and the potential to build cash value over time.

Retirees

Universal life insurance may be suitable for retirees who want flexibility in premium payments and death benefits, along with the ability to access cash value if needed.

High-Net-Worth Individuals

Variable life insurance might be a suitable choice for high-net-worth individuals who are comfortable with investment risks and want the potential for higher returns.

How to Obtain a Life Insurance Quote

When it comes to getting a life insurance quote, the process can be relatively simple if you know what information is needed and why accuracy is crucial.

Requesting a Life Insurance Quote Online

Obtaining a life insurance quote online has become increasingly popular due to its convenience. Most insurance providers have websites where you can fill out a form with your basic information to receive a quote.

Information Required for a Life Insurance Quote

When requesting a life insurance quote, you will typically need to provide details such as your age, gender, health history, lifestyle habits, desired coverage amount, and policy term. It's important to be honest and accurate with this information to ensure the quote you receive is as close to the actual cost as possible.

Importance of Providing Accurate Details

Providing accurate details when requesting a life insurance quote is crucial because the information you provide will directly impact the cost of your policy. For example, if you underestimate your age or fail to disclose pre-existing health conditions, you may receive a lower quote initially, but your actual premium could be significantly higher when the insurance company verifies the information.

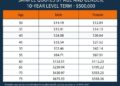

Understanding Life Insurance Premiums

Life insurance premiums are the amount of money you pay to the insurance company in exchange for coverage. These premiums are calculated based on several factors, including your age, health, lifestyle, occupation, and the type of policy you choose.

How Life Insurance Premiums are Calculated

- Your age: Younger individuals typically pay lower premiums as they are considered lower risk.

- Health: Your overall health and any pre-existing conditions can impact your premium.

- Lifestyle: Factors such as smoking, alcohol consumption, and participation in high-risk activities can increase your premium.

- Occupation: Some professions are considered riskier than others, which can affect your premium.

- Type of policy: The amount of coverage, length of the policy, and additional riders can also impact your premium.

Tips to Lower Life Insurance Premiums

- Maintain a healthy lifestyle by exercising regularly and eating a balanced diet.

- Avoid smoking and excessive alcohol consumption.

- Compare quotes from different insurance companies to find the best rate.

- Consider term life insurance for lower premiums compared to whole life insurance.

- Bundle your life insurance with other insurance policies for potential discounts.

Annual vs. Monthly Premium Payments

- Annual premium payments: Paying your premium annually can sometimes result in savings compared to monthly payments, as insurance companies may offer discounts for upfront payments.

- Monthly premium payments: Monthly payments offer more flexibility for budgeting, but may end up costing slightly more over the course of the year due to administrative fees.

Last Recap

In conclusion, life insurance quotes play a pivotal role in securing one's financial future and providing peace of mind. By understanding the nuances of life insurance quotes, individuals can make well-informed choices that align with their needs and goals.

FAQ Overview

What factors influence life insurance quotes?

Factors such as age, health condition, lifestyle choices, and coverage amount can significantly impact life insurance quotes.

How can I lower my life insurance premiums?

To lower premiums, maintain a healthy lifestyle, avoid high-risk activities, and consider term life insurance for more affordable coverage.

What information is needed to request a life insurance quote?

Typically, you will need to provide details like age, health history, coverage amount, and desired policy duration.

What's the difference between term life insurance and whole life insurance?

Term life insurance offers coverage for a specific period, while whole life insurance provides lifelong coverage with an investment component.

How are life insurance premiums calculated?

Premiums are calculated based on factors like age, health, coverage amount, and policy type, among others.