Exploring the realm of Homeowners Insurance (High Intent), this introduction sets the stage for an in-depth look at the intricacies of safeguarding your most valuable asset.

Providing insights that delve into the nuances of coverage options, risk mitigation, and premium factors, this overview aims to equip homeowners with the knowledge needed to navigate the complexities of insurance policies with confidence.

Importance of Homeowners Insurance

Homeowners insurance is essential for protecting your most valuable asset - your home. It provides financial protection against unexpected events that could result in costly repairs or even the loss of your home.

Risks Covered by Homeowners Insurance

Homeowners insurance can protect against a variety of risks, including:

- Damage caused by natural disasters such as hurricanes, tornadoes, or wildfires.

- Theft and vandalism.

- Accidental damage to your property or personal belongings.

- Liability for injuries that occur on your property.

Examples of Situations Where Homeowners Insurance is Beneficial

Here are some scenarios where having homeowners insurance can make a significant difference:

- If a tree falls on your roof during a storm, causing extensive damage, homeowners insurance can cover the cost of repairs.

- In the unfortunate event of a break-in where valuable items are stolen, homeowners insurance can help replace the lost items.

- If someone is injured on your property and decides to sue you, homeowners insurance can help cover legal expenses and potential settlements.

Types of Coverage

When it comes to homeowners insurance, there are different types of coverage options available to protect your home and belongings. Understanding these coverage options is essential to ensure that you have the right level of protection in place.

Basic Coverage

Basic coverage in a homeowners insurance policy typically includes protection for your dwelling, other structures on your property, personal property, and loss of use. Dwelling coverage helps repair or rebuild your home in case of damage from covered perils like fire or windstorms.

Other structures coverage protects structures like a detached garage or shed. Personal property coverage helps replace belongings like furniture, electronics, and clothing if they are damaged or stolen. Loss of use coverage can help cover additional living expenses if you need to temporarily relocate due to damage to your home.

Additional Coverage Options

In addition to basic coverage, homeowners can opt for additional coverage options like personal liability protection, medical payments coverage, and scheduled personal property coverage. Personal liability coverage can help protect you if someone is injured on your property and sues you for damages.

Medical payments coverage can help pay for medical expenses if someone is injured on your property, regardless of who is at fault. Scheduled personal property coverage allows you to insure high-value items like jewelry, art, or collectibles for their full value.

Significance of Liability Coverage

Liability coverage is crucial for homeowners as it provides financial protection in case someone is injured on your property and holds you responsible for their injuries. Without liability coverage, you could be personally liable for medical bills, legal fees, and even court-awarded damages.

Having liability coverage in your homeowners insurance policy can give you peace of mind and protect your assets in case of a lawsuit.

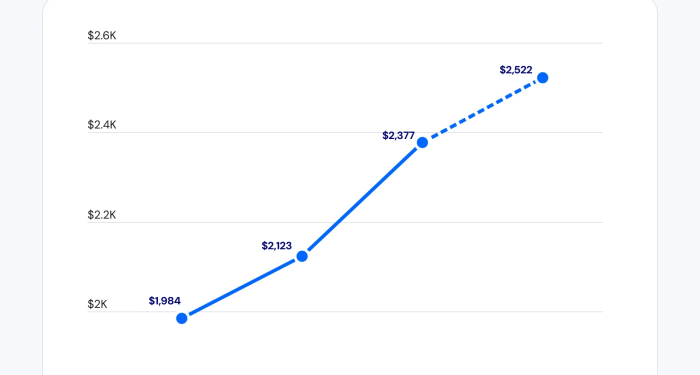

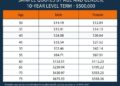

Factors Affecting Premiums

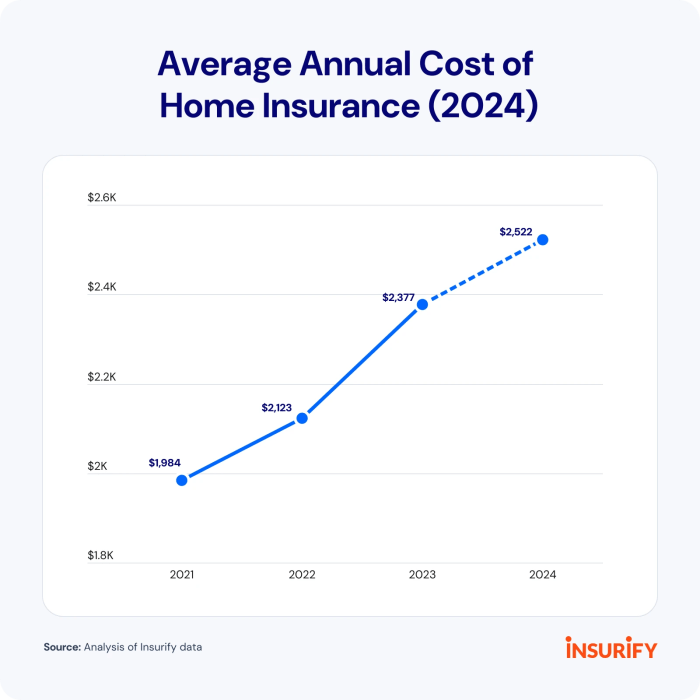

When it comes to determining homeowners insurance premiums, insurance companies consider various factors that can impact the cost of coverage. Factors such as location, home value, and deductible choices play a significant role in how much homeowners will pay for their insurance.

Location

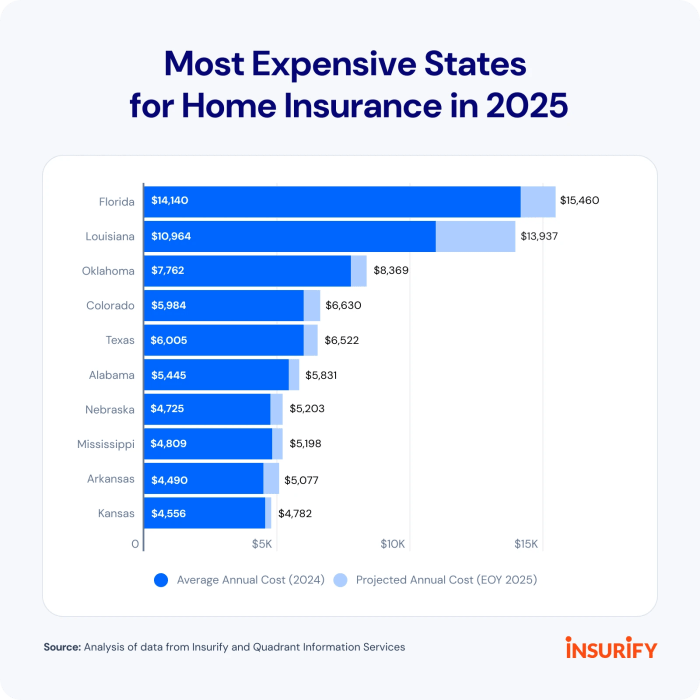

One key factor that affects homeowners insurance premiums is the location of the property. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance premiums due to the increased risk of damage.

Additionally, homes located in high-crime areas may also have higher premiums as there is a higher risk of theft or vandalism.

Home Value

The value of the home itself is another important factor in determining insurance premiums. More expensive homes typically require higher coverage limits, which can result in higher premiums. Insurance companies consider the cost to rebuild or repair the home in the event of damage when determining the premium amount.

Deductible Choices

The deductible amount chosen by the homeowner can also impact insurance costs. A deductible is the amount the homeowner must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the premium cost, but it also means the homeowner will have to pay more in the event of a claim.

On the other hand, a lower deductible will result in a higher premium but lower out-of-pocket costs at the time of a claim.

Tips to Lower Premiums

- Consider bundling your homeowners insurance with other policies, such as auto insurance, for potential discounts.

- Take steps to improve home security, such as installing alarms or deadbolts, to reduce the risk of theft.

- Maintain a good credit score, as some insurance companies use credit history to determine premiums.

- Review your policy annually and make adjustments as needed to ensure you are not overpaying for coverage.

Claims Process

When it comes to filing a homeowners insurance claim, it's important to understand the steps involved and what homeowners should do in case of property damage or loss. Let's dive into the details of the claims process and discuss common pitfalls to avoid.

Filing a Claim

When you experience property damage or loss, the first step is to contact your insurance company as soon as possible. They will guide you through the process and provide you with the necessary forms to fill out.

Documenting the Damage

It's crucial to document the damage by taking photos or videos before making any repairs. This evidence will help support your claim and ensure a smoother process with the insurance company.

Meeting with the Adjuster

After filing a claim, an insurance adjuster will assess the damage to determine the coverage and extent of the loss. Be sure to provide all necessary documentation and cooperate with the adjuster to expedite the claim.

Receiving the Settlement

Once the claim is approved, you will receive a settlement offer from the insurance company. Review the offer carefully and make sure it adequately covers the damages. If you have any concerns, don't hesitate to discuss them with your insurance provider.

Common Pitfalls to Avoid

- Delaying the filing of a claim can result in complications and potential denial of coverage.

- Not keeping thorough documentation of the damage can lead to difficulties in proving your claim.

- Failing to communicate promptly and effectively with the insurance company can prolong the claims process.

Coverage Exclusions

When it comes to homeowners insurance, it's crucial to understand what is not covered under your policy. Coverage exclusions are limitations on the types of incidents or damages that may not be eligible for reimbursement. Being aware of these exclusions can help homeowners make informed decisions about their coverage and avoid any surprises in the event of a claim.

Common Exclusions in Homeowners Insurance Policies

- Earth movement: Most standard policies do not cover damages caused by earthquakes, landslides, or sinkholes.

- Flood damage: Homeowners insurance typically excludes coverage for damages caused by floods. A separate flood insurance policy may be necessary.

- Normal wear and tear: Insurance is designed to cover sudden and accidental damages, not those resulting from aging or lack of maintenance.

- Acts of war: Damages caused by war, terrorism, or nuclear incidents are usually excluded from coverage.

Examples of Situations Where Coverage May Be Limited or Denied

- If a homeowner fails to maintain their property adequately, resulting in damages, the insurance company may deny the claim due to negligence.

- If a homeowner operates a business out of their home and does not have the proper commercial insurance, any damages related to the business may not be covered.

- If a homeowner makes a fraudulent claim, providing false information or exaggerating damages, the insurance company may deny coverage.

Ensuring Adequate Coverage for Potential Exclusions

- Review your policy carefully to understand what is and isn't covered. Consider additional coverage options for excluded perils.

- Maintain your property regularly to prevent damages that could be denied due to neglect.

- Consult with your insurance agent to discuss any specific concerns or coverage needs you may have.

Epilogue

Concluding our discussion on Homeowners Insurance (High Intent), we've unraveled the layers of protection and financial security that a robust policy can offer. With a keen understanding of coverage types, premium determinants, and claims processes, homeowners are empowered to make informed decisions to safeguard their homes effectively.

Expert Answers

What are common exclusions in homeowners insurance policies?

Common exclusions can include damages from floods, earthquakes, and routine wear and tear. It's important to review your policy to understand these limitations.

How can homeowners lower their insurance premiums?

Homeowners can lower premiums by increasing their home security, bundling policies, maintaining a good credit score, and periodically reviewing and updating their coverage.

What steps are involved in filing a homeowners insurance claim?

The steps typically involve documenting the damage, contacting your insurance company, meeting with adjusters, and providing necessary information to support your claim.