When it comes to full coverage auto insurance, the road to understanding can be both enlightening and complex. From unraveling the intricacies of coverage components to navigating the cost factors, this guide will shed light on all you need to know.

Overview of Full Coverage Auto Insurance

Full coverage auto insurance provides comprehensive protection for your vehicle, going beyond the basic coverage required by law. It typically includes a combination of collision, comprehensive, and liability coverage.

Components of Full Coverage Policies

- Collision Coverage: This component helps cover the cost of repairs or replacement if your vehicle is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This part of the policy covers damages to your vehicle from events such as theft, vandalism, natural disasters, or hitting an animal.

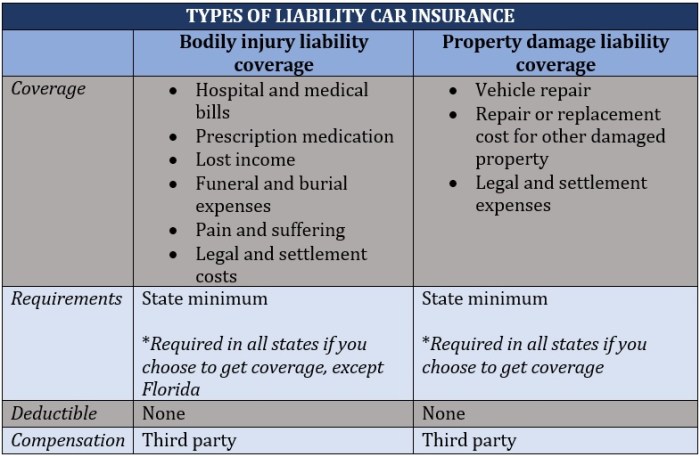

- Liability Coverage: This protects you in case you are at fault in an accident and covers the costs of property damage and bodily injuries to others involved.

- Uninsured/Underinsured Motorist Coverage: This coverage helps pay for damages if you are hit by a driver who does not have insurance or enough coverage to fully compensate you.

Importance of Having Full Coverage

Having full coverage auto insurance is crucial as it provides a higher level of protection for your vehicle and finances. While basic coverage may meet legal requirements, it may not be enough to cover significant damages or losses in case of an accident.

With full coverage, you have peace of mind knowing that you are better prepared for various unexpected situations on the road.

Benefits of Full Coverage Auto Insurance

Full coverage auto insurance offers a wide range of benefits that can provide peace of mind and financial protection in various situations.

Comprehensive Coverage

Full coverage auto insurance includes comprehensive coverage, which protects your vehicle from non-collision incidents such as theft, vandalism, fire, or natural disasters. This coverage ensures that your car is protected in a wide range of scenarios beyond just accidents.

Coverage for Uninsured/Underinsured Motorists

Full coverage insurance also includes coverage for uninsured or underinsured motorists. This means that if you are involved in an accident with a driver who does not have insurance or enough coverage to pay for damages, your own insurance policy will help cover the costs.

Collision Coverage

With full coverage auto insurance, you have collision coverage, which pays for damages to your vehicle in the event of a collision, regardless of fault. This coverage is essential for repairing or replacing your car after an accident.

Medical Payments Coverage

Full coverage insurance often includes medical payments coverage, which helps pay for medical expenses for you and your passengers in the event of an accident. This can be crucial in covering medical bills that may not be fully covered by health insurance.

Comparison with Other Types of Insurance

Full coverage auto insurance offers more extensive protection compared to basic liability insurance, which only covers damages to other vehicles and property in accidents where you are at fault. While full coverage may come with a higher premium, the added protection can be invaluable in various circumstances.

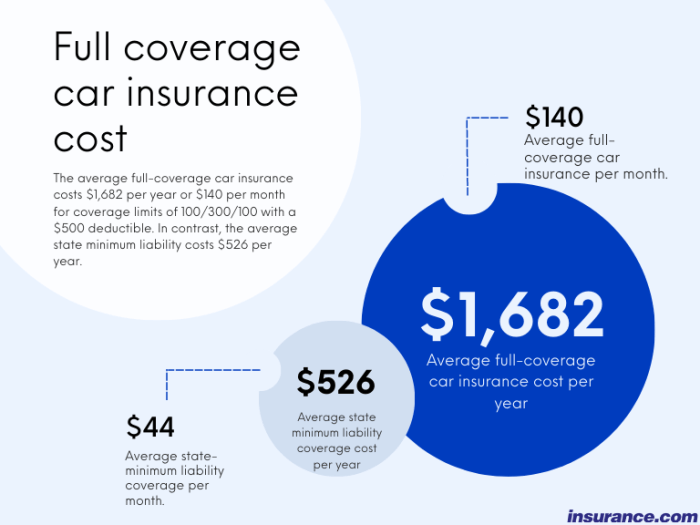

Cost Factors of Full Coverage Auto Insurance

When it comes to full coverage auto insurance, the cost can vary significantly depending on several factors. Understanding what influences the premiums can help you make informed decisions and potentially save money on your policy.

Driving Record

Your driving record plays a significant role in determining the cost of your full coverage auto insurance. If you have a history of accidents or traffic violations, insurance companies may consider you a high-risk driver, leading to higher premiums. On the other hand, a clean driving record can help lower your insurance costs.

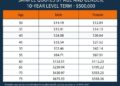

Age

Age is another factor that can impact the cost of full coverage auto insurance. Younger drivers, especially teenagers, are often charged higher premiums due to their lack of experience on the road. On the other hand, older drivers may be eligible for discounts based on their driving history.

Location

Where you live can also affect how much you pay for full coverage auto insurance. Urban areas with higher rates of accidents and thefts typically have higher premiums compared to rural areas. Additionally, the state regulations and insurance requirements can also influence the cost of your policy.

Vehicle Type

The type of vehicle you drive can impact the cost of your full coverage auto insurance. Expensive cars or vehicles with high repair costs may result in higher premiums. On the other hand, safety features, anti-theft devices, and the overall safety rating of your vehicle can help lower your insurance costs.

Tips to Lower Cost

To potentially lower the cost of your full coverage auto insurance, consider the following tips:

- Compare quotes from multiple insurance providers to find the best rate.

- Take advantage of discounts for safe driving, bundling policies, or having anti-theft devices.

- Improve your credit score, as some insurance companies use it to determine your premium.

- Consider raising your deductible to lower your monthly payments, but be prepared to pay more out of pocket in case of a claim.

- Drive safely and avoid accidents or traffic violations to maintain a clean driving record.

Understanding Coverage Limits and Deductibles

When it comes to full coverage auto insurance, understanding coverage limits and deductibles is crucial for making informed decisions that suit your needs and budget. Coverage limits refer to the maximum amount your insurance provider will pay out for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in.

Impact of Coverage Limits and Deductibles on Premiums

- Higher coverage limits typically result in higher premiums since the insurance company is taking on more risk by agreeing to pay out a larger sum in the event of a claim.

- On the other hand, choosing a higher deductible can lower your premiums since you are agreeing to cover a larger portion of the costs before your insurance comes into play.

- It's essential to strike a balance between coverage limits and deductibles that align with your financial situation and the level of protection you desire.

Recommendations for Selecting Coverage Limits and Deductibles

- Consider your budget and how much you can comfortably afford to pay out of pocket in the event of a claim when choosing your deductible.

- Assess the value of your vehicle and your risk tolerance to determine appropriate coverage limits that provide adequate protection without overpaying for coverage you may not need.

- Consult with your insurance agent or provider to understand how different coverage limits and deductibles can impact your premiums and coverage options.

Claims Process with Full Coverage Auto Insurance

When it comes to dealing with an insurance claim for your vehicle, having full coverage auto insurance can provide you with peace of mind. Understanding the process involved in filing a claim, verifying coverage, and maximizing benefits is essential. Here we will discuss the steps and tips to help you navigate the claims process effectively.

Filing a Claim with Full Coverage Policy

- Immediately report the incident to your insurance provider.

- Provide all necessary information such as policy details, incident description, and any supporting documentation.

- An adjuster will be assigned to review your claim and determine coverage.

Coverage Verification and Evaluation Process

- Insurance company will verify your coverage and assess the damage or loss.

- An inspection of the vehicle may be required to evaluate the extent of the damage.

- The adjuster will review the claim, consider policy terms, and determine the amount of coverage.

Tips to Expedite the Claims Process and Maximize Benefits

- Keep detailed records of the incident, including photos, witness statements, and police reports.

- Cooperate fully with the insurance company and provide all requested information promptly.

- Understand your policy limits and deductible to ensure you receive the maximum benefits available.

- Stay in communication with your adjuster and follow up on the progress of your claim.

Outcome Summary

In conclusion, full coverage auto insurance offers a comprehensive shield against the uncertainties of the road. With a deeper understanding of coverage limits, deductibles, and the claims process, you can confidently drive ahead knowing you're well-protected.

General Inquiries

What does full coverage auto insurance entail?

Full coverage auto insurance typically includes both liability coverage and comprehensive and collision coverage, offering a wider range of protection.

How can I lower the cost of full coverage insurance?

You can potentially lower the cost by maintaining a clean driving record, choosing a higher deductible, and taking advantage of discounts offered by insurance providers.

What are coverage limits and deductibles?

Coverage limits refer to the maximum amount your insurance company will pay for a covered claim, while deductibles are the amount you must pay before your insurance kicks in.