Embark on a journey to explore the top health insurance companies in the market, comparing coverage, plans, and customer reviews to help you make an informed decision.

Delve into the nuances of different types of health insurance plans, understanding their benefits, limitations, and when they might be most suitable for your needs.

Research on Top Health Insurance Companies

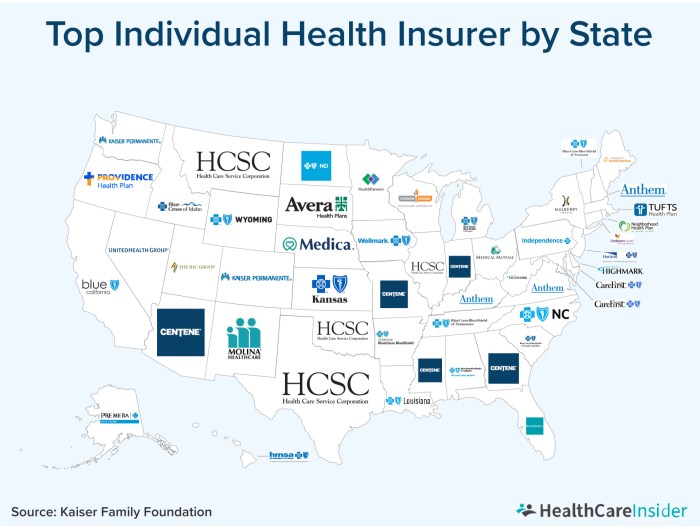

When looking for the best health insurance provider, it's essential to research and compare the leading companies in the market. Factors such as coverage, plans, customer reviews, financial stability, and reputation play a crucial role in making an informed decision.

Leading Health Insurance Providers

- Company A: Known for its comprehensive coverage options and excellent customer service.

- Company B: Offers a wide range of affordable plans with high customer satisfaction ratings.

- Company C: Known for its strong financial stability and a diverse set of health insurance products.

Comparison of Coverage and Plans

- Company A offers a variety of plans tailored to different needs, including individual, family, and group coverage.

- Company B provides extensive coverage for preventive care, prescription drugs, and specialist consultations.

- Company C offers flexible plans with options for add-on benefits such as dental and vision coverage.

Customer Reviews and Reputation

- Company A has received positive feedback from customers regarding claim processing and overall satisfaction.

- Company B is praised for its responsive customer support and easy-to-understand policy terms.

- Company C has built a strong reputation for transparency, reliability, and prompt resolution of customer queries.

Financial Stability and Reputation

- Company A has a solid financial standing and a history of timely claim settlements.

- Company B is backed by a reputable network of healthcare providers and has a strong track record of financial stability.

- Company C is known for its commitment to ethical practices and financial transparency, instilling trust in its policyholders.

Types of Health Insurance Plans

Health insurance plans come in various types to cater to different needs and preferences. Each type offers a unique set of coverage, benefits, and limitations. Understanding these differences can help individuals choose the most suitable plan for their specific requirements.

1. Health Maintenance Organization (HMO)

An HMO plan typically requires individuals to select a primary care physician (PCP) who coordinates all healthcare services. In-network care is covered, and referrals are needed to see specialists. HMOs usually have lower out-of-pocket costs but less flexibility in choosing healthcare providers.

2. Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers, both in and out of network, without needing referrals. While out-of-network care is covered, it comes with higher costs. PPOs are suitable for those who prioritize provider choice and are willing to pay higher premiums for more flexibility.

3. Exclusive Provider Organization (EPO)

EPO plans are a hybrid between HMOs and PPOs, where individuals must use in-network providers but do not require referrals to see specialists. Out-of-network care is generally not covered, except in emergencies. EPOs offer a balance between cost savings and provider choice.

4. High Deductible Health Plan (HDHP) with Health Savings Account (HSA)

HDHPs come with high deductibles and lower premiums, making them cost-effective options for healthy individuals who don't anticipate frequent medical expenses. HSAs allow individuals to save money tax-free for medical expenses. HDHPs are suitable for those looking to save on premiums and take a more active role in managing their healthcare costs.

5. Point of Service (POS) Plan

POS plans combine features of HMOs and PPOs, allowing individuals to choose between in-network and out-of-network care. Referrals are needed to see specialists, similar to HMOs. POS plans offer a balance between cost savings and provider choice, making them suitable for those who want some flexibility in their healthcare options.

Factors to Consider When Choosing a Health Insurance Company

When selecting a health insurance provider, there are several key factors that individuals should consider to ensure they are getting the coverage that best suits their needs.

Network Coverage

Network coverage is crucial when choosing a health insurance company. Make sure that your preferred doctors, hospitals, and specialists are included in the network to avoid unexpected out-of-network costs.

Premiums, Deductibles, and Copayments

Premiums are the monthly costs you pay for insurance coverage, while deductibles are the amount you must pay out of pocket before your insurance kicks in. Copayments are fixed amounts you pay for services. Consider your budget and healthcare needs when evaluating these factors.

Additional Features

Look for additional features offered by health insurance companies, such as telemedicine services, wellness programs, and prescription drug coverage. These can enhance your overall healthcare experience and provide added value for your premium payments.

Customer Satisfaction and Reviews

When it comes to choosing a health insurance provider, customer satisfaction and reviews play a crucial role in the decision-making process. Analyzing customer feedback can provide valuable insights into the quality of service, claims processing efficiency, and overall coverage satisfaction offered by popular health insurance companies.

Let's delve into the common feedback received from customers and how it can impact your choice of a health insurance provider.

Customer Service

Customer service is a key aspect of any health insurance company, as it directly impacts the overall experience of policyholders. Positive reviews often highlight responsive customer service representatives who are knowledgeable and helpful in addressing queries and concerns. On the other hand, negative feedback may point to long wait times, difficulty in reaching customer support, or unsatisfactory resolution of issues.

Claims Processing

Efficient claims processing is essential for a smooth experience when utilizing health insurance benefits. Customers appreciate timely processing of claims, clear communication regarding the status of their claims, and minimal hassle during the reimbursement process. Complaints related to delayed claims processing, denied claims without proper justification, or confusing paperwork can significantly impact customer satisfaction.

Coverage Satisfaction

Ultimately, the satisfaction of policyholders with the coverage offered by their health insurance provider is a critical factor. Positive reviews often mention comprehensive coverage options, including access to a wide network of healthcare providers, affordable premiums, and minimal out-of-pocket expenses.

Negative feedback may highlight limitations in coverage, unexpected costs not covered by the policy, or complex policy terms that are difficult to understand.Customer reviews provide valuable insights into the real-world experiences of individuals who have interacted with health insurance companies.

By considering these reviews, you can gain a better understanding of the strengths and weaknesses of different providers, helping you make an informed decision when selecting a health insurance company that aligns with your needs and preferences.

Final Conclusion

In conclusion, navigating the world of health insurance companies can be complex, but armed with the right knowledge, you can choose a provider that meets your needs and offers peace of mind.

User Queries

What are the key factors to consider when choosing a health insurance company?

Factors to consider include network coverage, premiums, deductibles, copayments, and additional features like telemedicine and prescription drug coverage.

How do customer reviews impact the decision-making process for selecting a health insurance provider?

Customer reviews play a crucial role by providing insights into customer service, claims processing, and overall coverage satisfaction, influencing the decision-making process.