Exploring the realm of auto insurance near me, this introduction aims to provide a detailed and informative overview of the topic. From the importance of having auto insurance to factors to consider when choosing a provider, this guide covers essential aspects that every driver should know.

Whether you're a seasoned driver or a newcomer to the world of auto insurance, this guide is designed to help you navigate the complexities of finding the right coverage near your location.

Importance of Auto Insurance

Auto insurance is a crucial aspect of responsible driving that provides financial protection in case of accidents or other unforeseen events on the road.

Types of Coverage Options

- Liability Coverage: Covers damages and injuries to others if you are at fault in an accident.

- Collision Coverage: Pays for repairs to your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if you are in an accident with a driver who has no insurance or insufficient coverage.

Consequences of Driving Without Auto Insurance

Driving without auto insurance can lead to serious consequences, such as:

- Legal Penalties: In many states, driving without insurance is illegal and can result in fines, license suspension, or even jail time.

- Financial Risk: Without insurance, you are personally responsible for all costs related to accidents, including property damage and medical bills.

- Lack of Protection: Without insurance, you have no financial safety net in case of an accident, leaving you vulnerable to significant financial loss.

Finding Auto Insurance Near Me

When looking for auto insurance near you, it's important to consider the benefits of choosing a local provider. Not only can they offer personalized service, but they also have a better understanding of the specific insurance needs in your area.

Tips for Searching Local Auto Insurance Providers

- Ask for recommendations from friends, family, or colleagues who live in the same area.

- Use online search engines to find insurance agents near your location.

- Check local business directories or insurance association websites for a list of providers in your area.

Benefits of Choosing a Local Insurance Provider

- Easy access to face-to-face meetings with agents for a more personalized experience.

- Local providers are more familiar with the specific risks and regulations in your area.

- Quick response times in case of emergencies or claims due to proximity.

Step-by-Step Guide to Locate Auto Insurance Agents in Your Area

- Start by searching online for insurance agents in your city or town.

- Check the websites of local insurance companies to see if they have offices near you.

- Visit insurance comparison websites to get quotes from multiple local providers.

- Contact the agents directly to schedule a meeting or discuss your insurance needs.

Factors to Consider

When choosing an auto insurance provider, there are several key factors to consider that can impact the coverage options, deductibles, and premiums offered. Personal factors such as age, driving record, and type of vehicle can also play a significant role in determining insurance rates.

Coverage Options

- Liability coverage: This is mandatory in most states and covers costs associated with injuries or property damage you cause to others in an accident.

- Comprehensive coverage: Protects your vehicle from non-collision related incidents like theft, vandalism, or natural disasters.

- Collision coverage: Covers damage to your vehicle in case of an accident with another vehicle or object.

Deductibles

- A deductible is the amount you must pay out of pocket before your insurance kicks in to cover the rest.

- Higher deductibles usually result in lower premiums, but it means you'll have to pay more upfront in case of a claim.

Premiums

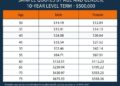

- Premiums are the amount you pay for your insurance policy, typically on a monthly or annual basis.

- Factors that can impact premiums include your driving history, age, location, and the type of vehicle you drive.

Personal Factors

- Age: Younger drivers are often considered higher risk and may face higher insurance rates.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums.

- Type of Vehicle: The make and model of your car can impact insurance rates, with luxury or sports cars typically costing more to insure.

Understanding Coverage

Auto insurance policies typically include various types of coverage to protect you and your vehicle in different situations. Here, we will detail the differences between liability, collision, comprehensive, and uninsured motorist coverage, along with examples of scenarios where each type of coverage would be beneficial.

Liability Coverage

Liability coverage helps pay for the damages and injuries you cause to others in an accident where you are at fault. This coverage is typically required by law and includes bodily injury liability and property damage liability. For example, if you rear-end another vehicle and the driver suffers whiplash, liability coverage would help cover their medical expenses and vehicle repairs.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object, regardless of fault. For instance, if you accidentally hit a pole while backing out of a parking spot, collision coverage would cover the cost of repairing your car.

Comprehensive Coverage

Comprehensive coverage helps pay for damages to your vehicle that are not caused by a collision, such as theft, vandalism, fire, or natural disasters. For example, if a tree falls on your car during a storm, comprehensive coverage would help cover the cost of repairs.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you if you are in an accident caused by a driver who does not have insurance or does not have enough insurance to cover the damages. For instance, if you are hit by an uninsured driver and sustain injuries, uninsured motorist coverage would help cover your medical expenses.

Final Wrap-Up

As we conclude our exploration of auto insurance near me, it becomes evident that securing the right coverage is not just a legal requirement but also a crucial financial safeguard. Remember to weigh your options carefully, consider all factors, and choose wisely to protect yourself on the road.

Essential FAQs

Why is auto insurance important?

Auto insurance is essential for drivers as it provides financial protection in case of accidents, theft, or damage to your vehicle. It is also a legal requirement in most states.

How can I find auto insurance providers near me?

You can search for local auto insurance providers by using online tools, contacting insurance agents in your area, or asking for recommendations from friends and family.

What factors should I consider when choosing an auto insurance provider?

Key factors to consider include coverage options, deductibles, premiums, customer service, and the provider's reputation. Personal factors like age, driving record, and type of vehicle also impact insurance rates.

What are the different types of coverage included in auto insurance?

Auto insurance policies typically include liability, collision, comprehensive, and uninsured motorist coverage. Each type offers different protection in various scenarios.

When is each type of coverage beneficial?

Liability coverage helps pay for damages to others in an accident you cause, collision coverage covers damage to your vehicle in a crash, comprehensive coverage protects against non-collision incidents like theft or natural disasters, and uninsured motorist coverage helps if you're in an accident with an uninsured driver.