Diving into the world of auto insurance comparison, this guide aims to shed light on the importance of making informed decisions when it comes to selecting the right coverage for your vehicle. From understanding key factors to exploring different types of coverage, this article will equip you with the knowledge needed to navigate the complex world of auto insurance policies.

Importance of Auto Insurance Comparison

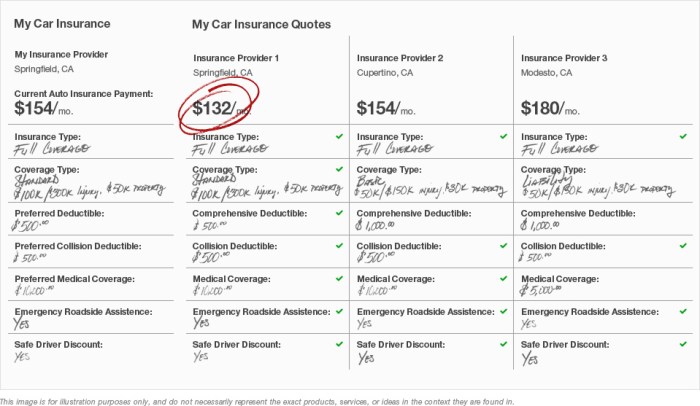

When it comes to securing the right coverage for your vehicle, comparing auto insurance policies is crucial. By taking the time to compare different options, you can ensure that you are getting the best coverage at a competitive price.

Benefits of Auto Insurance Comparison

- Access to a Wide Range of Options: By comparing auto insurance policies, you can explore a variety of coverage options and choose the one that best suits your needs.

- Potential Cost Savings: Comparing policies can help you find more affordable rates and discounts that may not be available with your current provider.

- Better Coverage: Through comparison, you can find policies with better coverage limits and additional perks that offer more comprehensive protection for your vehicle.

- Improved Customer Service: Researching different insurance companies allows you to assess their customer service reputation, ensuring you receive quality support when needed.

Saving Money with Auto Insurance Comparison

Auto insurance comparison can lead to significant cost savings in the long run. By finding a more affordable policy, you can reduce your monthly premiums and overall insurance expenses. Additionally, comparing policies can help you uncover discounts and special offers that may not have been available otherwise, resulting in substantial savings over time.

Factors to Consider

When comparing auto insurance policies, there are several key factors to consider to ensure you are getting the coverage that best fits your needs and budget.

Coverage Limits

- Coverage limits determine the maximum amount your insurance company will pay for a covered claim. It is essential to review these limits carefully to make sure they align with your financial situation and potential liabilities.

- Higher coverage limits typically mean higher premiums, but they can provide better protection in the event of a major accident or lawsuit.

- It's crucial to strike a balance between adequate coverage limits and affordable premiums to avoid being underinsured or overpaying for coverage you may not need.

Deductibles and Premiums

- Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, while lower deductibles mean higher premiums.

- Consider your financial situation and how much you can afford to pay upfront in the event of a claim when choosing a deductible. It's important to choose a deductible that you can comfortably cover without causing financial strain.

- Premiums are the amount you pay for your insurance policy. It's important to compare premiums from different insurers to find the most competitive rates while still maintaining the coverage you need.

- Factors that can influence your premiums include your driving record, age, location, type of vehicle, and coverage options. Be sure to provide accurate information to insurers to receive accurate premium quotes.

Types of Coverage

When it comes to auto insurance, there are several types of coverage options available to motorists. Understanding these different types of coverage can help you make informed decisions when comparing insurance policies.

Liability Coverage

Liability coverage is the most basic type of auto insurance required by law in most states. This coverage helps pay for damage and injuries you cause to others in an accident. It typically includes bodily injury liability coverage and property damage liability coverage.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters. This coverage is optional but can provide valuable protection for your vehicle.

Collision Coverage

Collision coverage helps pay for damage to your vehicle in the event of a collision with another vehicle or object. This coverage is also optional but can be beneficial, especially if you have a newer or more expensive vehicle.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage helps pay for medical expenses and lost wages for you and your passengers regardless of who is at fault in an accident. This coverage is required in some states and can provide important financial protection in the event of injuries.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage helps protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your expenses. This coverage can help fill the gap and ensure you are not left with significant out-of-pocket costs.

Understanding Policy Details

Before finalizing an auto insurance policy, it is crucial to thoroughly understand the policy details to make an informed decision. This involves familiarizing yourself with key terms such as exclusions, endorsements, and limits within the policy.

Exclusions

Exclusions refer to specific situations or conditions that are not covered by your auto insurance policy. It is essential to be aware of these exclusions to avoid any surprises when filing a claim. Common exclusions may include intentional damage, racing, or using your vehicle for commercial purposes

Endorsements

Endorsements are modifications or additions to your standard auto insurance policy to provide extra coverage for specific needs. It is important to understand any endorsements included in your policy, as they can enhance your coverage based on your individual requirements.

Examples of endorsements may include rental car coverage or roadside assistance.

Limits

Policy limits determine the maximum amount your insurer will pay for covered claims. It is crucial to review and understand these limits to ensure you have adequate coverage in case of an accident or other unforeseen events. Pay attention to both the overall policy limit and individual limits for different types of coverage within your policy.Reading the fine print and understanding these policy details can help you avoid any surprises or misunderstandings during the claims process.

By being well-informed about exclusions, endorsements, and limits, you can make sure that your auto insurance policy meets your specific needs and provides the necessary protection in various situations.

Utilizing Comparison Tools

Using online auto insurance comparison tools can greatly benefit consumers in finding the best coverage at the most competitive rates. These tools allow users to easily compare multiple insurance quotes from various providers, saving time and effort in the process.

Popular Comparison Websites and Features

- Some popular auto insurance comparison websites include Insurify, The Zebra, and Gabi. These platforms offer user-friendly interfaces and provide quick and accurate quotes based on individual needs and preferences.

- Features of these comparison tools may include side-by-side quote comparisons, customization options for coverage limits and deductibles, and the ability to filter results based on specific criteria such as price, coverage options, and customer reviews.

- Additionally, some comparison websites may offer additional resources such as educational articles, customer reviews, and insurance provider ratings to help users make informed decisions.

Simplifying the Comparison Process

- By using online comparison tools, consumers can easily compare quotes from multiple insurance companies in one place, eliminating the need to visit individual websites or contact agents separately.

- These tools streamline the process by providing all relevant information in one centralized location, allowing users to make side-by-side comparisons and choose the policy that best fits their needs and budget.

- Furthermore, online comparison tools often update quotes in real-time, ensuring that users have access to the most up-to-date pricing and coverage options available in the market.

Discounts and Savings

When comparing auto insurance policies, it is essential to consider the various discounts and savings opportunities offered by insurance providers. These discounts can significantly impact the overall cost of your policy and help you maximize your savings.

Types of Discounts

- Multi-policy Discount: Insurance companies often offer discounts to customers who bundle multiple policies, such as auto and home insurance, with the same provider.

- Safe Driver Discount: If you have a clean driving record with no accidents or traffic violations, you may be eligible for a safe driver discount.

- Good Student Discount: Students with good grades may qualify for a discount on their auto insurance premiums.

- Low Mileage Discount: If you drive fewer miles than the average driver, you may be eligible for a low mileage discount.

- Vehicle Safety Features Discount: Installing safety features such as anti-theft devices or airbags in your vehicle can make you eligible for discounts.

Maximizing Savings

- Bundle Policies: Consider bundling your auto insurance with other policies to qualify for multi-policy discounts.

- Shop Around: Compare quotes from multiple insurance providers to find the best rates and discounts available.

- Ask About Discounts: Inquire with insurance companies about the various discounts they offer and how you can qualify for them.

Closing Notes

In conclusion, auto insurance comparison is not just about finding the best deal, but also about ensuring that you have the adequate coverage to protect yourself and your vehicle in various scenarios. By utilizing the information provided in this guide, you can make well-informed decisions that will benefit you in the long run.

FAQ Overview

What are the key benefits of comparing auto insurance policies?

Comparing auto insurance policies allows you to find the most suitable coverage for your needs at the best price, ensuring you are adequately protected while saving money.

How do coverage limits impact the auto insurance comparison process?

Coverage limits determine the maximum amount your insurer will pay for a covered claim. Understanding these limits helps you select a policy that offers the right level of protection for your vehicle.

What are some common types of auto insurance coverage available for comparison?

Common types of coverage include liability, comprehensive, collision, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

How can utilizing online auto insurance comparison tools benefit you?

Online comparison tools simplify the process of obtaining and comparing multiple insurance quotes, helping you make an informed decision based on your specific needs and budget.

What are some tips for maximizing savings through auto insurance comparison?

Maximize savings by exploring discounts offered by insurers, bundling policies, qualifying for specific discounts, and negotiating based on comparison results to secure the best deal.