Embark on a journey to unravel the complexities of life insurance with our guide on life insurance explained. Delve into the realm of financial security and planning as we break down the various types of life insurance policies and their significance in safeguarding your future.

Introduction to Life Insurance

Life insurance is a financial product designed to provide a lump sum payment to beneficiaries in the event of the policyholder's death. This can help replace lost income, cover outstanding debts, or fund future expenses. Life insurance plays a crucial role in financial planning by ensuring the financial security of loved ones after the policyholder's passing.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, typically 10-30 years. It offers a death benefit if the policyholder passes away during the term.

- Whole Life Insurance: Offers coverage for the entire life of the policyholder, as long as premiums are paid. It also includes a cash value component that grows over time.

- Universal Life Insurance: Provides flexible premiums and an adjustable death benefit. It also accumulates cash value based on interest rates.

- Variable Life Insurance: Allows the policyholder to allocate premiums among different investment options, with the cash value and death benefit dependent on the performance of these investments.

Term Life Insurance

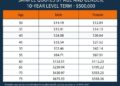

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiaries receive a death benefit. Here are the key features of term life insurance:

Key Features of Term Life Insurance:

- Term length: The policyholder selects the term length, such as 10, 20, or 30 years.

- Fixed premiums: Premiums remain the same throughout the term.

- Death benefit: If the policyholder dies during the term, beneficiaries receive a lump sum payout.

- Affordable: Term life insurance is generally more affordable compared to other types of life insurance.

When is Term Life Insurance Suitable?

Term life insurance is suitable for individuals who have specific financial obligations for a set period, such as paying off a mortgage, funding a child's education, or covering a business loan. It is also ideal for those looking for temporary coverage at an affordable rate.

Comparison with Other Types of Life Insurance:

- Whole life insurance: Term life insurance offers coverage for a specific term, while whole life insurance provides coverage for the entire lifetime of the policyholder.

- Universal life insurance: Unlike term life insurance, universal life insurance offers flexibility in premium payments and death benefits.

- Variable life insurance: Term life insurance does not include an investment component like variable life insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid. Unlike term life insurance, which only provides coverage for a specific period, whole life insurance offers lifelong protection.

Characteristics of Whole Life Insurance

- Guaranteed death benefit payout

- Fixed premiums that do not increase over time

- Accrual of cash value over the policy's lifespan

- Ability to borrow against the cash value

Benefits of Whole Life Insurance

- Provides lifelong coverage and peace of mind

- Guaranteed cash value accumulation

- Can serve as an investment vehicle

- Offers tax-deferred growth on cash value

Building Cash Value with Whole Life Insurance

Whole life insurance policies have a cash value component that grows over time. A portion of the premiums paid goes towards this cash value, which can be accessed through policy loans or withdrawals. The cash value can be used for various purposes, such as supplementing retirement income or covering unexpected expenses.

Scenarios Where Whole Life Insurance is Beneficial

- For individuals looking for lifelong coverage and guaranteed benefits

- For estate planning purposes to provide an inheritance for beneficiaries

- As a way to accumulate tax-deferred savings while ensuring financial protection

- For individuals who want the flexibility to borrow against the policy's cash value in times of need

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. This policy provides flexibility in premium payments and death benefits, allowing policyholders to adjust their coverage and savings over time.

Features of Universal Life Insurance

- Flexible Premiums: Policyholders can adjust their premium payments based on their financial situation.

- Adjustable Death Benefit: The death benefit can be modified to suit the policyholder's needs.

- Cash Value Component: A portion of the premium is allocated to a cash value account, which grows over time and can be used for loans or withdrawals.

Differences from Whole Life and Term Life Insurance

- Flexibility: Universal life insurance offers more flexibility in premium payments and death benefits compared to whole life insurance.

- Investment Component: Unlike term life insurance, universal life insurance has a cash value component that can accumulate over time.

Flexibility and Investment Components

Universal life insurance allows policyholders to adjust their premiums and death benefits as needed. The cash value component provides a savings element that can grow over time, offering potential investment opportunities within the policy.

Suitable Choice for Universal Life Insurance

- Individuals looking for flexible premium payments and death benefits.

- People interested in building cash value within their life insurance policy.

- Those seeking a combination of life insurance protection and investment potential.

Factors to Consider When Choosing a Life Insurance Policy

Choosing a life insurance policy is a crucial decision that requires careful consideration of various factors to ensure you select the right coverage for your needs.

Coverage Amount

- Consider your current financial obligations, such as mortgage payments, debts, and future expenses like college tuition for your children.

- Determine the amount needed to replace your income and provide financial support to your beneficiaries in case of your untimely passing.

- Factor in inflation and potential changes in your financial situation over time when deciding on the coverage amount.

Premiums

- Compare premium rates from different insurance providers to find a policy that fits your budget while offering adequate coverage.

- Understand how premium payments may change over the life of the policy, especially for policies with adjustable rates.

- Avoid underestimating the importance of paying premiums on time to keep your policy active and prevent it from lapsing.

Beneficiaries

- Select beneficiaries for your life insurance policy carefully, ensuring they are individuals who will benefit most from the financial protection it provides.

- Consider naming contingent beneficiaries in case your primary beneficiaries are unable to receive the death benefit.

- Review and update your beneficiaries regularly to reflect any life changes, such as marriages, divorces, or the birth of children.

Riders

- Explore optional policy riders that can enhance your coverage, such as accelerated death benefits, disability income riders, or long-term care riders.

- Understand the additional costs associated with riders and evaluate whether the benefits they offer align with your specific needs and circumstances.

- Consult with your insurance agent or financial advisor to determine which riders may be beneficial for your policy.

Evaluating Financial Needs

- Assess your current financial situation, including income, expenses, assets, and liabilities, to determine the amount of coverage needed.

- Consider your long-term financial goals and how life insurance can help protect your loved ones and secure their financial future.

- Seek guidance from a financial professional to conduct a comprehensive analysis of your financial needs and recommend suitable life insurance options.

Choosing the Right Policy

- Take the time to research and compare different types of life insurance policies to find one that aligns with your goals and preferences.

- Seek quotes from multiple insurance companies to evaluate pricing, coverage options, and customer reviews before making a decision.

- Consider working with a licensed insurance agent or advisor who can provide personalized recommendations based on your unique financial situation and goals.

Life Insurance Claims Process

When a policyholder passes away, filing a life insurance claim becomes necessary for the beneficiaries to receive the death benefit. Understanding the steps involved in this process and common reasons for claim denials is crucial for a smooth experience during a difficult time.

Steps in Filing a Life Insurance Claim

- Notify the Insurance Company: Inform the insurance company about the policyholder's death as soon as possible.

- Submit Required Documents: Typically, beneficiaries need to provide a death certificate, policy documents, and any other relevant paperwork.

- Wait for Review: The insurance company will review the claim and may conduct an investigation before approving the payout.

- Receive Payment: Once the claim is approved, beneficiaries will receive the death benefit as specified in the policy.

What Beneficiaries Need to Do After the Policyholder’s Death

- Contact the Insurer: Reach out to the insurance company to start the claims process.

- Gather Documentation: Collect all necessary documents, such as the death certificate and policy details.

- Follow Up: Stay in touch with the insurer to ensure the claim is processed promptly.

- Plan for the Funds: Decide how to use the death benefit wisely to meet financial needs.

Common Reasons for Life Insurance Claim Denials

- Non-Disclosure: If the policyholder failed to disclose important information or misrepresented facts in the application, the claim may be denied.

- Policy Lapse: If premiums were not paid, resulting in the policy lapsing before the insured's death, the claim may not be valid.

- Exclusions: Some policies have specific exclusions that may prevent a claim from being paid out, such as death due to certain activities or pre-existing conditions.

- Fraud: Any suspicion of fraudulent activity related to the claim can lead to a denial and further investigation.

Importance of Regularly Reviewing Life Insurance Policies

It is crucial to regularly review your life insurance policies to ensure that your coverage aligns with your current needs and circumstances. Life is constantly changing, and your policy should reflect these changes to provide adequate protection for you and your loved ones.

Life Events that May Necessitate Updating or Changing a Life Insurance Policy

Life events such as marriage, the birth of a child, a change in employment, or the purchase of a new home can all impact your life insurance needs. It is essential to review your policy after these events to make any necessary adjustments.

- Marriage: When you get married, you may want to increase your coverage to ensure financial security for your spouse.

- Birth of a Child: The addition of a new family member may require additional coverage to provide for their future needs.

- Change in Employment: If you switch jobs or experience a significant increase in income, you may need to adjust your coverage accordingly.

- Home Purchase: Buying a new home often means taking on more financial responsibility, making it essential to review your policy to account for this change.

Checklist for Reviewing Life Insurance Coverage

- Evaluate Your Current Financial Situation: Assess your current income, expenses, debts, and future financial goals to determine if your coverage is adequate.

- Review Your Beneficiaries: Ensure that your designated beneficiaries are up to date and accurately reflect your wishes.

- Assess Your Coverage Amount: Consider any changes in your financial obligations and adjust your coverage amount accordingly.

- Understand Policy Options: Familiarize yourself with any additional riders or options that may enhance your coverage based on your current needs.

- Compare Policies: Explore other life insurance options to see if there are better plans available that align with your current situation.

Closing Summary

In conclusion, life insurance serves as a crucial tool in securing your loved ones' financial future. By understanding the nuances of different policies and the claims process, you can make informed decisions to protect what matters most. Secure your legacy with the right life insurance policy today.

Frequently Asked Questions

What factors determine the coverage amount of a life insurance policy?

The coverage amount is typically determined by factors such as income, debts, future financial obligations, and the number of dependents.

Can I change beneficiaries on my life insurance policy?

Yes, you can typically change beneficiaries at any time by contacting your insurance provider and updating the necessary forms.

Is it possible to borrow against the cash value of a whole life insurance policy?

Yes, policyholders can often borrow against the cash value of a whole life insurance policy, providing a source of emergency funds if needed.

What are riders in a life insurance policy?

Riders are additional provisions that can be added to a life insurance policy to customize coverage, such as accelerated death benefits or accidental death coverage.

How often should I review my life insurance policy?

It is recommended to review your life insurance policy annually or whenever significant life events occur, such as marriage, childbirth, or major financial changes.