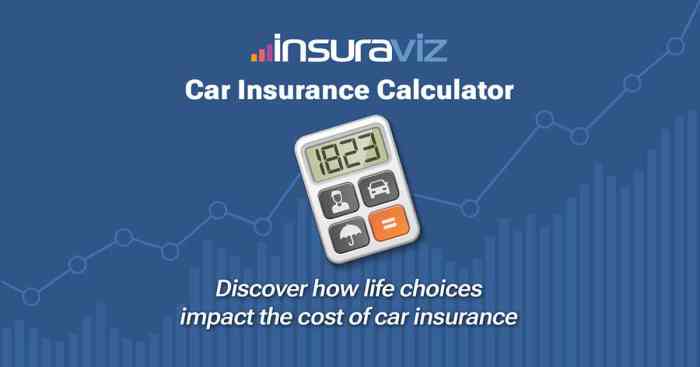

Car insurance calculator offers a powerful tool for individuals looking to navigate the complex world of insurance with precision. By harnessing the latest technology, this tool provides an accurate estimation of insurance costs, empowering users to make informed decisions. Let's delve into the realm of car insurance calculators and explore their myriad benefits.

Importance of a Car Insurance Calculator

Using a car insurance calculator can be highly beneficial for individuals looking to estimate their insurance costs accurately before making a decision. It offers convenience and efficiency compared to manual calculations.

Accurate Estimation of Insurance Costs

One of the key advantages of using a car insurance calculator is the ability to obtain a more precise estimate of insurance costs. By inputting specific details related to the vehicle, driving history, and coverage preferences, the calculator can generate a reliable quote tailored to the individual's needs.

Convenience of Using a Car Insurance Calculator

Car insurance calculators provide a user-friendly and efficient way to compare insurance quotes from various providers. Instead of spending time manually calculating costs or contacting multiple insurers for quotes, individuals can simply input their information into the calculator and receive instant estimates.

Factors Considered in a Car Insurance Calculator

When using a car insurance calculator, several key factors are taken into consideration to determine the insurance premium. These factors play a crucial role in calculating the cost of insurance and tailoring it to the individual's specific circumstances.

Age

Age is a significant factor in determining car insurance premiums. Younger drivers, especially those under the age of 25, are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher premiums as they are considered more prone to certain health conditions that could affect their driving.

Driving History

A driver's past driving record is another crucial factor in determining insurance costs. A history of accidents, traffic violations, or DUIs can significantly increase premiums as it indicates a higher risk of future claims. Conversely, a clean driving record with no accidents or violations can lead to lower insurance rates.

Type of Coverage

The type of coverage selected also impacts the insurance calculation. Comprehensive coverage that includes protection against a wide range of risks will naturally come with a higher premium compared to basic liability coverage. Additional coverage options such as collision, uninsured motorist, and personal injury protection will also affect the overall cost.

Deductible Amount

The deductible amount chosen by the policyholder plays a role in the insurance premium. A higher deductible means the policyholder will have to pay more out of pocket in the event of a claim, but it typically results in lower premiums.

On the other hand, a lower deductible leads to higher premiums but less upfront cost in case of a claim.

Coverage Limits

Insurance coverage limits refer to the maximum amount the insurance company will pay out for a claim. Higher coverage limits provide more financial protection but also come with higher premiums. Policyholders need to balance their coverage needs with their budget to determine the most suitable coverage limits for their situation.

How to Use a Car Insurance Calculator

Using a car insurance calculator online is a simple and efficient way to estimate your car insurance premium based on your specific needs and circumstances. Follow the step-by-step guide below to use a car insurance calculator effectively:

Information Required for an Accurate Estimate

To obtain an accurate insurance estimate using a car insurance calculator, you will need to provide the following information:

- Your personal details, including age, gender, and location

- Vehicle information, such as make, model, year, and value

- Driving history, including any past accidents or traffic violations

- Type of coverage you are looking for, such as liability, comprehensive, or collision

- Desired deductible amount

- Mileage driven per year

Types of Car Insurance Calculators and Their Functionalities

There are different types of car insurance calculators available online, each offering unique functionalities to help you estimate your insurance premium accurately. Some common types include:

- Basic Calculators: These calculators provide a general estimate based on standard factors such as age, location, and vehicle type.

- Advanced Calculators: Advanced calculators take into account more detailed information, such as driving history, to provide a more accurate premium estimate.

- Comparison Calculators: These calculators allow you to compare quotes from multiple insurance companies to find the best deal.

- Customized Calculators: Customized calculators let you tailor the inputs to match your specific needs and preferences, resulting in a personalized insurance estimate.

Benefits of Using a Car Insurance Calculator

Using a car insurance calculator before purchasing a policy can offer several advantages. It helps in comparing quotes from different insurance providers and assists in budgeting for insurance expenses effectively.

Comparing Insurance Quotes

- Allows you to input your specific details and requirements to generate accurate quotes from various insurance companies.

- Enables you to easily compare coverage options, deductibles, and premiums offered by different insurers side by side.

- Helps in selecting the most suitable policy that meets your needs and budget by evaluating multiple options conveniently.

Effective Budgeting

- By using a car insurance calculator, you can estimate the cost of insurance based on your driving record, vehicle information, and coverage preferences.

- Provides a clear breakdown of expenses, allowing you to plan your budget accordingly and avoid any financial surprises in the future.

- Helps in finding a balance between coverage benefits and premium costs to ensure you are getting the best value for your money.

Ultimate Conclusion

In conclusion, car insurance calculators stand as indispensable assets in the realm of insurance, offering clarity, accuracy, and efficiency to users. By leveraging these tools, individuals can confidently navigate the insurance landscape, ensuring optimal coverage at competitive rates. Dive into the world of car insurance calculators and unlock a realm of possibilities today.

FAQ

How can a car insurance calculator benefit me?

A car insurance calculator helps you estimate insurance costs accurately, allowing you to make informed decisions based on your budget and coverage needs.

What factors influence car insurance premiums?

Key factors like age, driving history, and type of coverage play a significant role in determining insurance premiums.

What information is required to use a car insurance calculator?

To obtain an accurate insurance estimate, you will typically need details such as your vehicle information, driving history, and desired coverage.

How can a car insurance calculator help in budgeting for insurance expenses?

By using a car insurance calculator, you can compare quotes from different providers, allowing you to budget effectively and choose a policy that meets your financial needs.