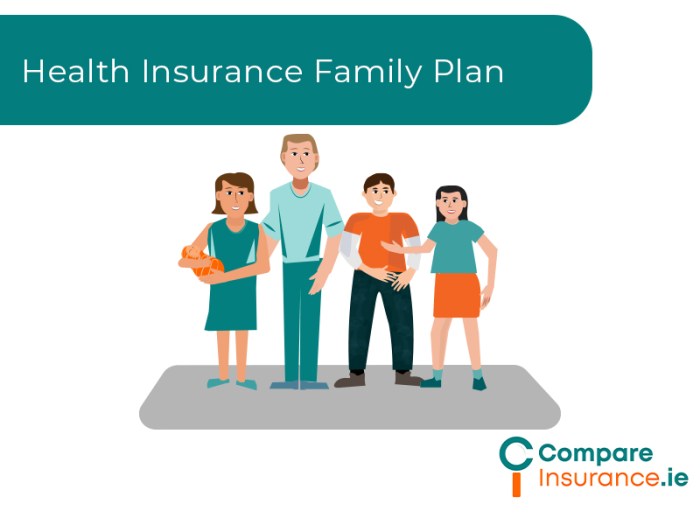

Diving into the realm of health insurance for families, this introduction aims to provide a comprehensive overview of the topic. From understanding different types of plans to evaluating key factors in decision-making, this guide will equip you with essential knowledge to make informed choices for your family's well-being.

As we delve deeper into the intricacies of health insurance for families, you will discover valuable insights that can help you navigate the complex landscape of healthcare coverage with confidence.

Overview of Health Insurance for Families

Health insurance for families is a type of insurance policy that provides coverage for medical expenses incurred by all family members. This includes parents, children, and sometimes even extended family members depending on the plan.Having health insurance for families is essential as it ensures that all family members have access to quality healthcare without the burden of high out-of-pocket expenses.

It provides financial protection in case of unexpected illnesses or accidents, giving peace of mind to families knowing that they can seek medical treatment when needed.

Benefits of Health Insurance for Families

- Comprehensive Coverage: Health insurance for families typically covers a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care.

- Cost Savings: By having a family health insurance plan, families can save money on medical expenses as the insurance helps cover a significant portion of the costs.

- Preventive Care: Many health insurance plans for families include coverage for preventive services such as vaccinations, screenings, and wellness exams, promoting overall health and well-being.

- Emergency Care: In case of emergencies, having health insurance ensures that family members can receive immediate medical attention without worrying about the financial implications.

- Continuity of Care: With health insurance coverage, families can establish relationships with healthcare providers and receive consistent medical care over time, leading to better health outcomes.

Types of Health Insurance Plans for Families

When it comes to health insurance plans for families, there are several options available to choose from. Each type of plan has its own unique features and benefits, catering to different needs and preferences.

Health Maintenance Organization (HMO)

An HMO plan typically requires members to choose a primary care physician (PCP) who serves as the main point of contact for all healthcare needs. Referrals are usually needed to see specialists, and services outside the network may not be covered except in emergencies.

While HMO plans often have lower out-of-pocket costs, they offer less flexibility in choosing healthcare providers.

Preferred Provider Organization (PPO)

PPO plans allow members to see any healthcare provider, both in and out of the network, without needing a referral. While there may be higher out-of-pocket costs compared to HMO plans, PPOs offer more flexibility and choice in selecting doctors and hospitals.

Some services may require pre-authorization for coverage.

Exclusive Provider Organization (EPO)

EPO plans are similar to PPO plans in that members can typically see any healthcare provider without a referral. However, EPOs do not cover any out-of-network services except in emergencies. These plans often have lower premiums compared to PPOs but may have limited provider networks.Each type of health insurance plan has its own advantages and limitations, so it's essential to carefully consider your family's healthcare needs and preferences when choosing the right plan for you.

Factors to Consider When Choosing Health Insurance for Families

When choosing health insurance for families, it is crucial to consider several key factors that can impact the coverage and costs. Factors such as deductibles, premiums, copayments, and healthcare provider networks play a significant role in making an informed decision.

Impact of Deductibles, Premiums, and Copayments

Understanding the impact of deductibles, premiums, and copayments is essential when selecting a health insurance plan for your family. Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Lower deductibles often come with higher premiums, while higher deductibles can lead to lower monthly costs but higher out-of-pocket expenses when you need medical care.

On the other hand, premiums are the monthly payments you make for your health insurance coverage. It is essential to find a balance between affordable premiums and adequate coverage for your family's needs. Additionally, copayments are fixed amounts that you pay for covered services, which can vary depending on the plan you choose.

Assessing the Network of Healthcare Providers

Another critical factor to consider is the network of healthcare providers included in the health insurance plan. Make sure that the plan you choose includes a network of doctors, specialists, and hospitals that are convenient and accessible for your family.

Check if your current healthcare providers are part of the plan's network to ensure continuity of care.

It is also important to consider whether you may need to obtain referrals to see specialists or if you have the flexibility to see out-of-network providers in case of emergencies. Understanding the network of healthcare providers can help you make an informed decision when selecting a health insurance plan for your family.

Coverage and Benefits of Health Insurance for Families

Health insurance for families typically includes coverage for a range of medical services and benefits to ensure the well-being of all family members.

Typical Coverage and Benefits

- Hospitalization: Most family health insurance plans cover expenses related to hospital stays, including room and board, surgeries, and other medical procedures.

- Doctor Visits: Coverage for visits to primary care physicians, specialists, and other healthcare providers is usually included.

- Prescription Drugs: Many plans provide coverage for prescription medications, either partially or in full, depending on the plan.

- Emergency Care: Coverage for emergency room visits and urgent care services is an essential benefit in family health insurance.

- Mental Health Services: Some plans include coverage for mental health treatment, counseling, and therapy sessions.

Common Exclusions or Limitations

- Elective Procedures: Cosmetic surgeries or other elective procedures may not be covered under family health insurance plans.

- Dental and Vision Care: Basic dental and vision services are often not included in standard health insurance plans and require separate coverage.

- Alternative Therapies: Services such as acupuncture, chiropractic care, or massage therapy may be excluded from coverage.

- Pre-existing Conditions: Some plans may have limitations on coverage for pre-existing medical conditions.

Preventive Services Covered

- Annual Check-ups: Most family health insurance plans cover preventive care visits, including annual physical exams and screenings.

- Immunizations: Vaccines for children and adults, as recommended by healthcare providers, are typically covered under preventive services.

- Screenings: Coverage for preventive screenings such as mammograms, colonoscopies, and blood tests is a common benefit in family health insurance plans.

Cost of Health Insurance for Families

When it comes to the cost of health insurance for families, several factors come into play to determine the overall price. These factors include the type of plan chosen, the number of family members covered, the age of family members, geographic location, and the level of coverage desired.

Determining Factors for Cost of Health Insurance

- The type of plan selected greatly impacts the cost. For example, a comprehensive plan with lower deductibles and copayments will typically have a higher monthly premium compared to a high-deductible plan.

- The number of family members covered under the plan will also influence the cost. Adding more family members to the policy will increase the premium.

- The age of family members plays a significant role in determining the cost, as older individuals generally require more healthcare services and are thus charged higher premiums.

- Geographic location is another factor, as healthcare costs can vary depending on the region. Urban areas tend to have higher healthcare expenses compared to rural areas.

- The level of coverage desired, such as additional benefits like vision or dental coverage, will add to the overall cost of the health insurance plan.

Strategies to Save on Health Insurance Premiums

- Consider opting for a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA) to save on premiums while still having coverage for major medical expenses.

- Shop around and compare different health insurance plans to find the most cost-effective option that meets your family's needs.

- Take advantage of employer-sponsored health insurance if available, as group plans tend to have lower premiums compared to individual plans.

- Look for subsidies or tax credits that may be available based on your income level to help reduce the cost of health insurance for your family.

Comparison of Employer-Sponsored Health Insurance vs. Individual Plans

Employer-sponsored health insurance plans often offer more affordable premiums for families compared to individual plans. This is because employers typically cover a portion of the premium costs, making it more cost-effective for employees to enroll in these group plans. Individual plans, on the other hand, may have higher premiums since the full cost falls on the individual or family without any employer contributions.

Closure

In conclusion, this discussion has shed light on the significance of health insurance for families, emphasizing the importance of thorough research and careful consideration when selecting a plan. By understanding the various aspects of coverage, benefits, and costs, families can make informed decisions that prioritize their health and financial security.

FAQ Summary

What are the key benefits of health insurance for families?

Health insurance for families provides financial protection against unexpected medical expenses, ensures access to quality healthcare services, and promotes overall well-being for all family members.

How can families save on health insurance premiums?

Families can save on health insurance premiums by comparing different plans, considering higher deductibles, utilizing employer-sponsored options, and exploring available discounts or subsidies.

What are common exclusions in family health insurance coverage?

Common exclusions in family health insurance coverage may include cosmetic procedures, experimental treatments, certain pre-existing conditions, and specific elective surgeries.