Delving into the realm of homeowners insurance companies, this guide offers insight into the various policies, rates, and top companies available in the market. As we navigate through the intricacies of homeowners insurance, readers are invited to explore the nuances of coverage options, factors affecting rates, and key considerations when filing a claim.

Types of Homeowners Insurance Policies

When it comes to homeowners insurance, there are several types of policies available to protect your home and belongings. Each type of policy offers different levels of coverage, so it's important to understand the options before making a decision.

Basic Form (HO-1)

The Basic Form policy is the most limited in terms of coverage, typically only providing protection against a few specific types of perils such as fire, lightning, and theft. This policy is best suited for homeowners on a tight budget who want minimal coverage.

Broad Form (HO-2)

The Broad Form policy offers more comprehensive coverage than the Basic Form, including protection against a wider range of perils like vandalism and falling objects. It is a good option for homeowners looking for a balance between coverage and cost.

Special Form (HO-3)

The Special Form policy is the most common type of homeowners insurance and provides coverage for the dwelling and personal property against all perils except those specifically excluded in the policy. This is recommended for most homeowners as it offers broad protection.

Tenant’s Form (HO-4)

The Tenant's Form policy is designed for renters and provides coverage for personal property and liability, but not for the dwelling structure itself. It is ideal for tenants who want to protect their belongings and liability risks.

Condo Form (HO-6)

The Condo Form policy is tailored for condominium owners and covers personal property, liability, and improvements made to the unit. It typically excludes coverage for the building structure itself, which is covered by the condo association's insurance.

Mobile Home Form (HO-7)

The Mobile Home Form policy is specifically for mobile or manufactured homes and offers similar coverage to a standard homeowners policy but tailored to the unique risks associated with mobile homes. It is essential for mobile homeowners to have this type of policy for adequate protection.

Older Home Form (HO-8)

The Older Home Form policy is designed for older homes that may not meet modern construction standards. It provides coverage based on the actual cash value of the home rather than the cost to replace it. This policy is suitable for historic or older homes with unique characteristics.

Factors Affecting Homeowners Insurance Rates

When it comes to determining homeowners insurance rates, insurance companies take into account several key factors that can impact the cost of coverage. These factors play a crucial role in calculating premiums and determining the level of risk associated with insuring a particular property.

Location

Location is a significant factor that insurance companies consider when setting homeowners insurance rates. Properties located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance premiums due to the increased risk of damage.

Additionally, homes in high-crime areas may also face higher insurance rates.

Home Value

The value of your home is another important factor that can affect homeowners insurance rates. More expensive homes typically require higher coverage limits, which can result in higher premiums. Insurance companies consider the cost of rebuilding or repairing your home in the event of damage or loss when determining insurance rates.

Coverage Limits

The coverage limits you choose for your homeowners insurance policy can also impact your insurance rates. Opting for higher coverage limits will result in higher premiums, as it increases the potential payout by the insurance company in case of a claim.

It's essential to carefully evaluate your coverage needs and strike a balance between adequate coverage and affordable rates.

Tips to Lower Insurance Rates

- Increase your home's security with features such as alarm systems, deadbolt locks, and smoke detectors to reduce the risk of theft or damage.

- Bundle your homeowners insurance with other policies like auto insurance to qualify for discounts from the insurance company.

- Maintain a good credit score, as insurance companies often use credit history as a factor in determining rates.

- Shop around and compare quotes from multiple insurance providers to find the best rates and coverage options for your specific needs.

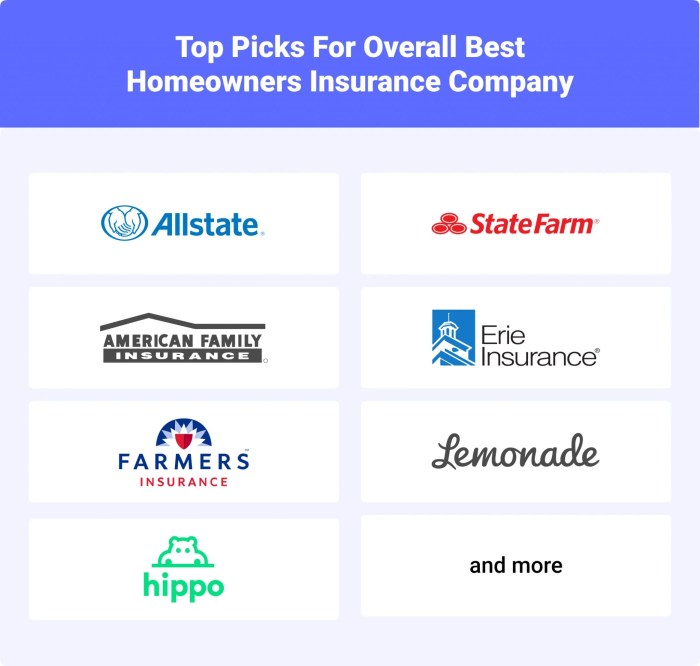

Top Homeowners Insurance Companies

When it comes to homeowners insurance, there are several top companies in the market that stand out for their financial strength, customer service reputation, and unique features. Let's take a look at some of these leading insurance providers:

Allstate

Allstate is known for its strong financial stability and excellent customer service. They offer a variety of coverage options for homeowners, including protection for your home, personal property, and liability. One unique feature of Allstate is their Claim RateGuard, which helps prevent your rates from increasing after filing a claim.

State Farm

State Farm is another top homeowners insurance company with a solid financial standing and a reputation for exceptional customer service. They provide customizable coverage options to fit your specific needs, along with discounts for bundling policies. State Farm also offers the unique feature of their HomeIndex tool, which helps you keep track of your home's inventory and value.

Amica Mutual

Amica Mutual is highly rated for both financial strength and customer satisfaction. They offer comprehensive homeowners insurance policies with options for additional coverage like identity fraud expense reimbursement. One standout feature of Amica Mutual is their dividend policy, where policyholders may receive a portion of the company's profits as a dividend.

USAA

USAA is well-known for its outstanding customer service and exclusive coverage options for military members and their families. They provide a range of homeowners insurance policies with features like replacement cost coverage and coverage for military uniforms. USAA also offers discounts for homes with security systems and fire alarms.

Filing a Homeowners Insurance Claim

When it comes to filing a homeowners insurance claim, there are specific steps that homeowners need to follow to ensure a smooth process and successful outcome. It's essential to be prepared and provide all the necessary information to the insurance company to expedite the claim process.

Steps Involved in Filing a Homeowners Insurance Claim

- Contact your insurance company as soon as possible after the incident occurs to report the claim.

- Document the damage or loss by taking photos or videos. This evidence will support your claim.

- Fill out the claim form provided by your insurance company with accurate information about the incident.

- Provide any additional documentation requested by the insurance company, such as estimates for repairs or replacements.

- Cooperate with the insurance adjuster who will assess the damage and determine the coverage for your claim.

What Homeowners Need to Prepare and Provide When Filing a Claim

- Policy details, including your policy number and coverage limits.

- Details of the incident, including the date, time, and cause of the damage or loss.

- Documentation of the damage, such as photos, videos, or receipts for damaged items.

- Contact information for any contractors or repair professionals involved in assessing or repairing the damage.

- Any other relevant information or documentation requested by the insurance company.

Tips to Ensure a Smooth and Successful Claims Process

- Report the claim to your insurance company promptly to avoid any delays in processing.

- Keep detailed records of all communication with the insurance company, including phone calls, emails, and letters.

- Follow up with the insurance company if you have not heard back within a reasonable timeframe.

- Be honest and accurate in providing information to the insurance company to avoid any complications or delays.

- Seek assistance from a public adjuster if you encounter any difficulties in the claims process.

Ultimate Conclusion

In conclusion, homeowners insurance is a crucial aspect of protecting one's property and assets. By understanding the different policies, factors influencing rates, and reputable companies in the industry, individuals can make informed decisions to safeguard their homes effectively. Stay informed, stay protected.

Q&A

What factors can impact homeowners insurance rates?

The location of the home, its value, the chosen coverage limits, and the homeowner's claims history can all influence insurance rates.

How can homeowners potentially lower their insurance rates?

Homeowners can lower their insurance rates by increasing home security, bundling policies, maintaining a good credit score, and shopping around for quotes.

What should homeowners prepare when filing an insurance claim?

Homeowners should prepare documents such as photos of damage, receipts for repairs, and any relevant policy information to facilitate the claims process.