Term life insurance rates set the stage for a fascinating exploration into the world of insurance. Understanding how these rates are determined and what factors influence them is crucial for anyone looking to secure the right coverage. In this detailed guide, we delve into the intricacies of term life insurance rates, shedding light on everything you need to know to make informed decisions about your financial future.

Overview of Term Life Insurance Rates

![Best 30 Year Term Life Insurance Rates [Compare Top Companies!] Best 30 Year Term Life Insurance Rates [Compare Top Companies!]](https://holiday.jobdeskindonesia.biz.id/wp-content/uploads/2025/12/64736922-fla_rates_30yr.jpg)

Term life insurance is a type of life insurance that provides coverage for a specific period of time, known as the term. Unlike permanent life insurance policies, such as whole life or universal life, term life insurance does not build cash value over time.

How Insurance Companies Determine Term Life Insurance Rates

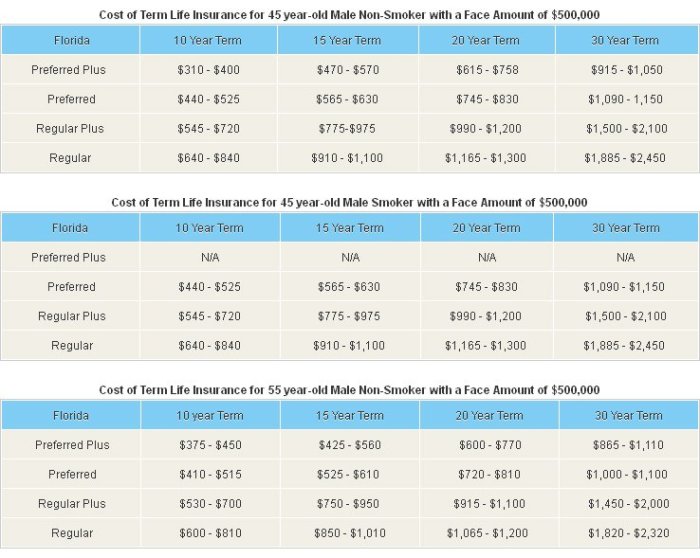

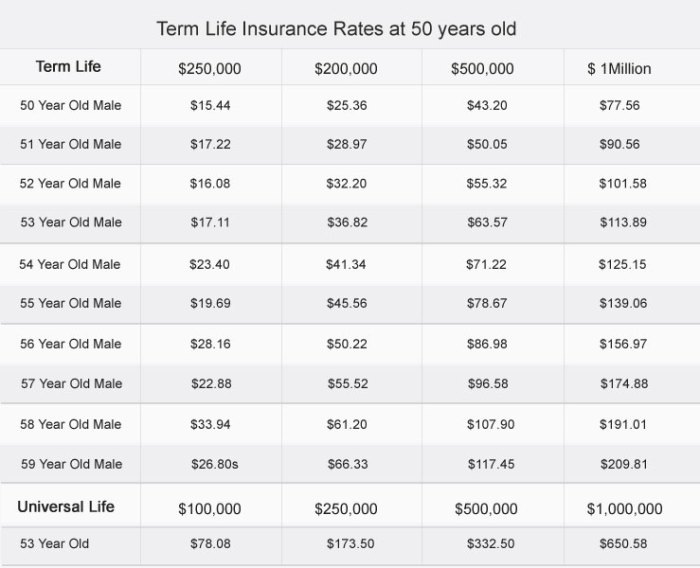

Insurance companies use various factors to determine term life insurance rates, including the age of the policyholder, their health status, the coverage amount selected, and the length of the term chosen.

Factors Influencing Term Life Insurance Rates

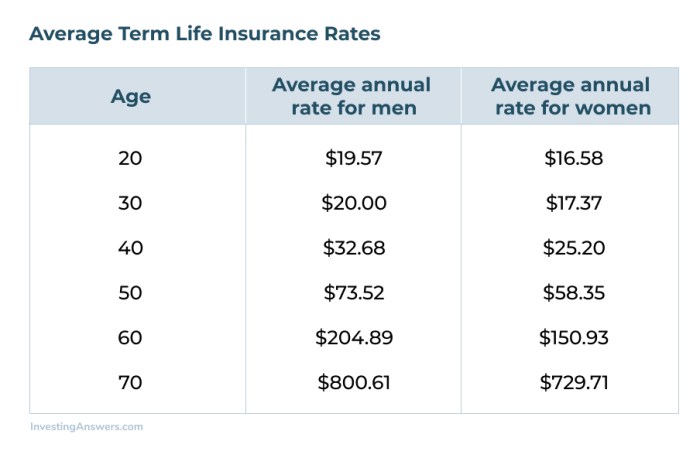

- The Age of the Policyholder: Younger individuals typically receive lower rates compared to older individuals, as they are considered less risky to insure.

- Health Status: Those with good health are likely to receive lower rates, while individuals with pre-existing medical conditions may face higher premiums.

- Coverage Amount: The higher the coverage amount selected, the higher the premium is likely to be.

- Term Length: Shorter terms generally have lower premiums, while longer terms may result in higher rates.

Factors Affecting Term Life Insurance Rates

When it comes to determining term life insurance rates, several factors play a crucial role in influencing the premiums individuals have to pay. These factors include age, health conditions, and lifestyle choices. Understanding how these elements impact insurance rates can help individuals make informed decisions when purchasing a term life insurance policy.

Age

Age is a significant factor that affects term life insurance rates. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered less risky to insure compared to older individuals.

For example, a 30-year-old non-smoker may pay significantly lower premiums than a 50-year-old non-smoker for the same coverage amount due to the difference in age and associated risk.

Health Conditions

Health conditions can also have a significant impact on term life insurance rates. Individuals with pre-existing health conditions or chronic illnesses may face higher premiums as they are considered higher risk by insurance companies. Common health conditions that may increase insurance rates include heart disease, cancer, diabetes, and high blood pressure.

Insurance providers may adjust rates based on the severity of the condition and its impact on life expectancy.

Lifestyle Choices

Lifestyle choices such as smoking, excessive alcohol consumption, and participation in high-risk activities can also affect term life insurance rates. Smokers typically pay higher premiums compared to non-smokers due to the increased health risks associated with smoking. Similarly, individuals who engage in high-risk activities such as skydiving or racing may face higher premiums to compensate for the elevated risk of accidental death or injury.

Making healthier lifestyle choices can help individuals secure more affordable term life insurance rates.

Comparing Term Life Insurance Rates

When looking to compare term life insurance rates from different insurance companies, it's essential to consider several factors to ensure you're getting the best coverage for your needs at a competitive price. Here's a guide on how to effectively compare term life insurance rates:

Importance of Considering Coverage Amount, Term Length, and Additional Riders

- Start by evaluating the coverage amount you need based on your financial obligations, such as mortgage, debts, and future expenses for your dependents. Make sure the policy provides adequate coverage to meet these needs.

- Next, consider the term length that aligns with your financial goals and the time period during which your dependents will need financial protection. Common term lengths are 10, 20, or 30 years.

- Additionally, think about adding riders to your policy for extra coverage, such as critical illness or disability riders. These can enhance your policy but may impact the overall cost.

Using Online Tools and Calculators to Compare Term Life Insurance Rates

- Take advantage of online tools and calculators provided by insurance companies or third-party websites to compare term life insurance rates easily.

- Enter your basic information, coverage needs, and desired term length into the tools to receive quotes from multiple insurers at once.

- Review the quotes carefully, considering the coverage amount, term length, riders, and total cost to determine the best option for your budget and needs.

Tips for Getting Affordable Term Life Insurance Rates

When it comes to securing affordable term life insurance rates, there are several strategies you can implement to lower your premiums and get the best coverage for your needs. From improving your health to choosing the right coverage amount and term length, these tips can help you save money while ensuring you have adequate protection for your loved ones.

Improving Health and Quitting Smoking

One of the most effective ways to lower your term life insurance rates is by improving your overall health. Insurance companies often take into account factors such as weight, blood pressure, cholesterol levels, and overall health when determining premiums. By adopting a healthier lifestyle, such as exercising regularly, eating a balanced diet, and avoiding harmful habits like smoking, you can significantly reduce your rates.

Purchasing at a Younger Age

Another key tip for getting affordable term life insurance rates is to purchase a policy at a younger age. Premiums are generally lower for younger individuals as they are considered lower risk by insurance companies. Locking in a policy at a young age can help you secure lower rates for the duration of your term, providing long-term cost savings.

Choosing the Right Coverage Amount and Term Length

When selecting a term life insurance policy, it's essential to carefully consider the coverage amount and term length that best suits your needs. Opting for a coverage amount that adequately protects your loved ones without being excessive can help you avoid paying higher premiums.

Additionally, choosing a term length that aligns with your financial obligations and long-term goals can ensure you get the best rates for your specific situation.

Final Wrap-Up

As we wrap up our discussion on term life insurance rates, it's clear that being informed and proactive is key to securing the best coverage at the most affordable rates. By considering the various factors that influence these rates and exploring ways to lower them, you can make smart choices that protect your loved ones and provide peace of mind for the future.

Essential Questionnaire

What factors can influence term life insurance rates?

Factors such as age, health status, coverage amount, and term length can all impact term life insurance rates.

How can I lower my term life insurance rates?

Improving your health, quitting smoking, and purchasing coverage at a younger age are all strategies that can help lower term life insurance rates.

Why is it important to compare term life insurance rates?

Comparing rates from different insurance companies allows you to find the best coverage options at the most competitive prices.

Can lifestyle choices affect term life insurance rates?

Yes, lifestyle choices like smoking, alcohol consumption, and engaging in high-risk activities can impact term life insurance rates.