Delving into the realm of life insurance companies, we uncover the vital role they play in securing individuals' financial future. From providing peace of mind to navigating the complex array of policies, these companies are pillars in the insurance industry landscape.

As we journey through the intricacies of life insurance, we unravel the nuances of different policies, the underwriting process, and the impact of technology on this ever-evolving sector. Stay tuned as we demystify the world of life insurance companies.

Introduction to Life Insurance Companies

Life insurance is a type of insurance that provides financial protection to the beneficiaries of the insured in the event of their death. It offers a way to ensure that loved ones are taken care of financially after the policyholder passes away.Life insurance companies play a crucial role in the financial market by offering various life insurance products to individuals seeking protection for their families and loved ones.

These companies collect premiums from policyholders and in return, provide a death benefit to the beneficiaries named in the policy.

Examples of Well-Known Life Insurance Companies

- Prudential Financial

- MetLife

- New York Life Insurance Company

- Northwestern Mutual

Types of Life Insurance Policies Offered

Life insurance companies typically offer various types of policies to cater to different needs and preferences. It is important to understand the differences between these policies to choose the one that best suits individual circumstances.

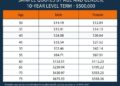

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term. This type of policy is usually more affordable compared to other options, making it a popular choice for those seeking temporary coverage.

Whole Life Insurance

Whole life insurance offers coverage for the entire lifetime of the insured. It includes a cash value component that grows over time, providing a savings element in addition to the death benefit. Premiums are generally higher than term life insurance but remain level throughout the policyholder's life.

Universal Life Insurance

Universal life insurance is a flexible policy that allows policyholders to adjust their premiums and death benefits. It also includes a cash value component that earns interest based on market performance. This type of policy provides more control and customization options compared to whole life insurance.Choosing the right life insurance policy depends on individual needs, financial goals, and risk tolerance.

It is essential to consider factors such as coverage amount, premium affordability, investment options, and long-term financial objectives when selecting a policy. Consulting with a financial advisor can help determine the most suitable policy based on personal circumstances.

Underwriting Process

Life insurance companies follow a detailed underwriting process to assess the risk associated with insuring an individual and determine the appropriate premium rates and coverage.

Factors Considered During Underwriting

During the underwriting process, several factors are taken into consideration to evaluate the risk profile of the applicant. These factors typically include:

- Age of the applicant

- Health condition and medical history

- Lifestyle habits (e.g., smoking, alcohol consumption)

- Occupation and income level

- Family medical history

- Existing insurance coverage

Impact of Underwriting on Premiums and Coverage

The results of the underwriting process directly affect the premiums and coverage offered to the policyholder. Applicants with lower risk profiles are likely to receive lower premium rates and higher coverage amounts, while those with higher risk factors may face higher premiums or even be denied coverage altogether.

Underwriting helps insurance companies manage risk effectively and ensure that policy pricing aligns with the level of risk associated with each individual applicant.

Claim Settlement Procedures

When it comes to life insurance, understanding the claim settlement procedures is crucial. This process involves the steps required to file a life insurance claim, how insurance companies assess and process claims, as well as common reasons for claim denials and how to avoid them.

Filing a Life Insurance Claim

- Notify the insurance company: Inform the insurance company about the policyholder's death as soon as possible.

- Submit required documents: Provide necessary documents such as the death certificate, policy documents, and any other relevant paperwork.

- Wait for claim processing: The insurance company will review the claim and may request additional information if needed.

- Receive claim decision: Once the claim is approved, the beneficiaries will receive the claim amount.

Assessment and Processing of Claims

- Verification of documents: Insurance companies verify the authenticity of submitted documents to prevent fraud.

- Investigation if necessary: In some cases, insurance companies may conduct further investigations to ensure the claim is valid.

- Determination of claim amount: The claim amount is calculated based on the policy terms, coverage, and any additional benefits.

- Payment to beneficiaries: Once the claim is processed, the beneficiaries receive the claim amount through the chosen payment method.

Common Reasons for Claim Denials

- Non-disclosure of information: Failure to disclose relevant information during the application process can lead to claim denials.

- Policy exclusions: Claims that fall under policy exclusions or limitations may be denied by the insurance company.

- Policy lapse: If the policy lapses due to non-payment of premiums, the claim may be denied.

- Fraudulent claims: Any attempt to submit a fraudulent claim will result in denial by the insurance company.

Technology and Innovation in the Life Insurance Industry

In today's digital age, technology plays a crucial role in transforming the way life insurance companies operate and serve their customers. From online policy management to AI-driven underwriting, innovations in technology have significantly enhanced the customer experience and streamlined processes within the industry.

Online Policy Management

Online policy management platforms allow policyholders to conveniently access their policy information, make premium payments, update personal details, and even purchase additional coverage online. This not only provides customers with greater control over their policies but also reduces the administrative burden on insurance companies.

Digital Claims Processing

Digital claims processing has revolutionized the way insurance claims are handled. By digitizing the claims process, insurers can expedite the assessment and settlement of claims, leading to faster payouts for beneficiaries. This not only improves customer satisfaction but also enhances the efficiency of the claims department.

AI-Driven Underwriting

Artificial intelligence (AI) has enabled life insurance companies to enhance their underwriting processes by leveraging data analytics and machine learning algorithms. AI-driven underwriting allows insurers to assess risk more accurately, offer personalized premiums based on individual risk profiles, and expedite the policy issuance process.

This not only reduces the time taken to underwrite policies but also ensures fair pricing for customers.

Regulatory Environment

In the life insurance industry, regulatory bodies play a crucial role in ensuring that companies operate ethically and in compliance with laws and regulations. These regulations are put in place to protect consumers, maintain industry stability, and promote fair competition.

Overview of Regulations

The regulations governing life insurance companies vary by country, but they generally include requirements related to capital adequacy, solvency, licensing, marketing practices, policy terms and conditions, and claims handling procedures. Regulatory bodies such as insurance commissions or departments oversee these companies to ensure they adhere to these regulations.

Impact on Operations and Offerings

Regulatory compliance impacts the operations and offerings of life insurance companies in several ways. Companies must allocate resources to ensure compliance, which can affect their cost structures. Regulations also influence the types of products and services that companies can offer, as well as the way they market and sell these products.

Non-compliance can result in fines, penalties, or even suspension of operations.

Role of Regulatory Bodies

Regulatory bodies play a vital role in protecting consumers by monitoring the financial stability of insurance companies, ensuring they have sufficient reserves to meet their obligations to policyholders. These bodies also investigate consumer complaints, mediate disputes, and enforce laws and regulations to maintain a level playing field in the industry.

By overseeing the operations of life insurance companies, regulatory bodies help safeguard the interests of policyholders and promote trust in the industry.

Summary

In conclusion, life insurance companies stand as guardians of financial stability, offering protection and security to individuals and families alike. As technology continues to reshape the industry and regulations ensure consumer rights, the future of life insurance companies promises innovation and reliability.

Dive deeper into this dynamic world to safeguard your tomorrows.

General Inquiries

What factors do life insurance companies consider during underwriting?

Factors such as age, health condition, lifestyle choices, and medical history are typically considered during the underwriting process.

How do technology and innovation impact the life insurance industry?

Technology has revolutionized the industry by offering online policy management, digital claims processing, and AI-driven underwriting, enhancing customer experience and operational efficiency.

What are common reasons for claim denials by life insurance companies?

Claim denials can occur due to misrepresentation of information, policy exclusions, non-disclosure of relevant details, or failure to meet policy requirements.