Diving into the realm of small business liability insurance, we unravel the importance, types, costs, decision-making process, and claims handling involved in securing your business. Stay tuned for a comprehensive guide that will help you navigate the complexities of safeguarding your business.

Importance of Small Business Liability Insurance

Small business liability insurance is crucial for protecting a business from potential risks and financial ruin. Without this type of insurance, small businesses are vulnerable to various legal and financial challenges that can arise unexpectedly.

Examples of Potential Risks

- Customer injuries on business premises

- Property damage caused by the business operations

- Advertising injuries, such as defamation or copyright infringement

Safeguarding from Lawsuits

Liability insurance can safeguard small businesses by covering legal fees, settlements, and judgments in case of lawsuits. This protection ensures that the business can continue to operate smoothly even in the face of legal challenges.

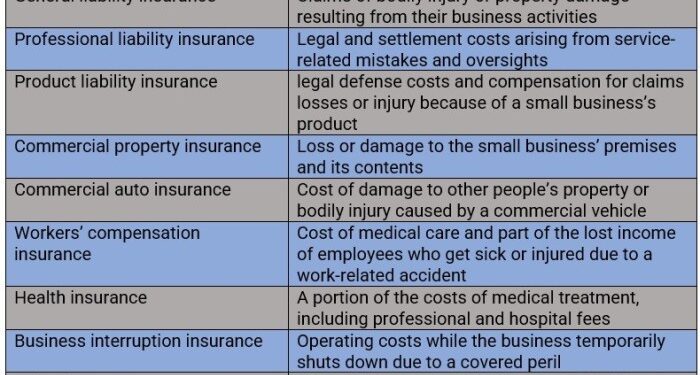

Types of Small Business Liability Insurance

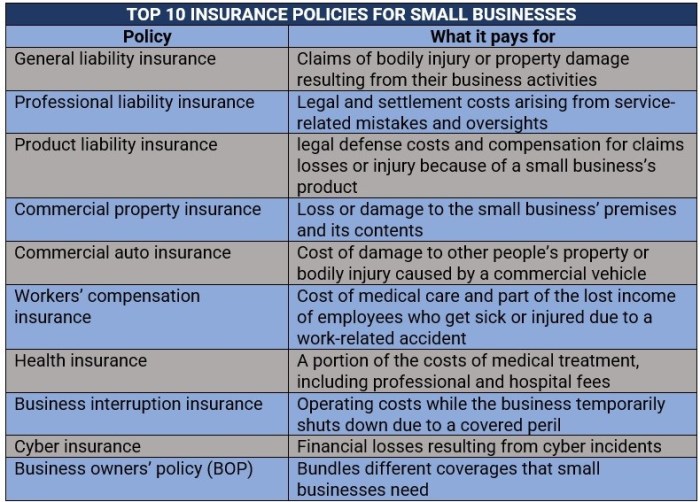

When it comes to protecting your small business from potential risks, having the right liability insurance in place is crucial. There are different types of liability insurance available for small businesses, each offering specific coverage tailored to different aspects of your business operations.

General Liability Insurance

General liability insurance is a fundamental coverage that helps protect your business from common risks. It typically covers claims related to bodily injury, property damage, advertising injury, and personal injury that occur on your business premises or as a result of your business operations.

This type of insurance can help cover legal fees, settlements, and medical expenses in case of a covered claim.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, also known as errors and omissions insurance, is designed to protect businesses that provide professional services or advice. This type of insurance covers claims of negligence, errors, or omissions that result in financial loss for clients. Professionals such as consultants, accountants, lawyers, and healthcare providers often opt for professional liability insurance to safeguard their businesses from potential lawsuits related to professional services.

Costs and Factors Influencing Small Business Liability Insurance

Small business liability insurance costs can vary significantly based on a variety of factors. Understanding these factors can help small business owners make informed decisions to manage and reduce their insurance expenses.

Factors Influencing Insurance Costs

- The size of the business: Larger businesses with more employees and higher revenue typically face higher liability insurance premiums. This is because the potential risk exposure is greater for businesses with more resources and operations.

- The nature of the business: The type of industry a business operates in can also impact insurance costs. For example, a construction company may face higher premiums compared to a consulting firm due to the higher risk of accidents and property damage associated with construction work.

- Claims history: A history of previous insurance claims can lead to higher premiums as it indicates a higher level of risk for the insurance provider. Businesses with a clean claims record may be able to negotiate lower premiums.

- Location: The geographic location of a business can influence insurance costs. Businesses located in areas prone to natural disasters or with high crime rates may face higher premiums due to the increased risk of property damage or liability claims.

Strategies to Reduce Insurance Costs

- Implement risk management practices: Proactively addressing potential risks and implementing safety measures can help reduce the likelihood of insurance claims, leading to lower premiums over time.

- Shop around for quotes: It's essential for small business owners to compare quotes from multiple insurance providers to find the most competitive rates. Working with an independent insurance agent can help streamline this process.

- Consider higher deductibles: Opting for a higher deductible can lower insurance premiums, although it means the business will have to pay more out of pocket in the event of a claim.

- Bundling policies: Some insurance providers offer discounts for bundling multiple types of insurance policies, such as liability, property, and commercial auto insurance. This can result in overall cost savings for the business.

How to Choose the Right Small Business Liability Insurance

Choosing the right small business liability insurance is crucial for protecting your business from potential risks and liabilities. Here are steps small business owners can take to determine the appropriate coverage needed.

Compare Different Insurance Providers

When selecting small business liability insurance, it is essential to compare different insurance providers and their offerings. Look into the coverage options, limits, deductibles, and premiums offered by each provider. Consider the reputation and financial stability of the insurance company to ensure they can meet their obligations in case of a claim

Review and Update Coverage Regularly

As your business grows and evolves, it is important to review and update your liability insurance coverage accordingly. Make sure that the coverage you have in place aligns with the current size and operations of your business. Failure to update your coverage could leave you exposed to risks that are not adequately covered by your policy.

Claims Process for Small Business Liability Insurance

When it comes to filing a liability insurance claim for a small business, it's essential to understand the steps involved to ensure a smooth process. From documenting incidents to navigating the claims process effectively, small business owners need to be proactive in protecting their interests.

Steps in Filing a Liability Insurance Claim

When filing a liability insurance claim for your small business, follow these steps:

- Contact your insurance provider immediately to report the incident.

- Document the details of the incident, including date, time, location, and parties involved.

- Gather evidence such as photos, videos, and witness statements to support your claim.

- Fill out the necessary claim forms provided by your insurance company.

- Cooperate with the insurance adjuster during the investigation process.

- Review the settlement offer and negotiate if necessary.

- Keep detailed records of all communication and documentation related to the claim.

Tips for Documenting Incidents and Gathering Evidence

Proper documentation and evidence collection are crucial for supporting your liability insurance claim. Here are some tips to help you:

- Take photos and videos of the scene and any damages or injuries.

- Collect witness statements and contact information.

- Maintain records of medical expenses, repair bills, and other relevant documents.

- Keep a journal of events and conversations related to the incident.

Navigating the Claims Process Effectively

During the claims process, small business owners should expect communication with their insurance company and adjuster. It's important to:

- Stay in touch with your insurance provider and provide any additional information requested promptly.

- Ask questions and seek clarification on any aspects of the claims process that you don't understand.

- Be patient and cooperative throughout the investigation and settlement negotiation.

- Consult with legal counsel if needed to ensure your rights are protected.

Closing Notes

Concluding our discussion on small business liability insurance, remember that protecting your business is not just a choice but a necessity in today's unpredictable landscape. With the right coverage in place, you can shield your business from potential risks and focus on its growth and success.

Quick FAQs

What specific risks does general liability insurance cover?

General liability insurance typically covers third-party bodily injuries, property damage, and advertising injury claims.

How can small businesses reduce liability insurance costs?

Small businesses can lower insurance costs by implementing risk management practices, maintaining a clean claims history, and choosing higher deductibles.

When should small business owners review and update their liability insurance coverage?

It's advisable for small business owners to review and update their coverage annually or whenever there are significant changes in the business operations or size.