Delving into the realm of Health Insurance (High Intent), we uncover the significance of securing the right plan for your well-being and financial security. From understanding different plan types to managing costs effectively, this guide aims to equip you with essential knowledge to make informed decisions.

As we navigate through the complexities of health insurance, we shed light on crucial aspects that often go unnoticed, ensuring you are well-prepared to safeguard your health and finances effectively.

Importance of Health Insurance

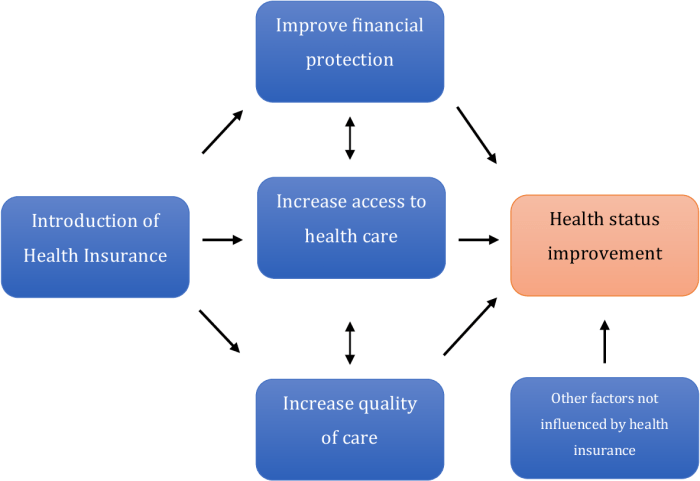

Health insurance plays a crucial role in safeguarding the well-being of individuals and families by providing financial protection in times of medical need.

Protection Against High Medical Costs

Health insurance helps mitigate the burden of expensive medical treatments and procedures that can lead to financial strain. For example, without insurance, the cost of a hospital stay, surgery, or ongoing treatment for a chronic condition can quickly accumulate, causing individuals to face significant out-of-pocket expenses.

Financial Stability and Access to Healthcare

Not having health insurance can jeopardize financial stability as individuals may be forced to deplete their savings or incur debt to cover medical expenses. Additionally, the lack of insurance can limit access to essential healthcare services, preventive care, and timely medical interventions, potentially compromising overall health outcomes.

Types of Health Insurance Plans

When it comes to health insurance, there are different types of plans available to individuals. Each type has its own coverage, costs, and benefits, catering to different needs and preferences. It is essential for individuals to understand these differences to choose the most suitable health insurance plan for themselves and their families.

Health Maintenance Organizations (HMOs)

Health Maintenance Organizations, or HMOs, typically require individuals to choose a primary care physician (PCP) and get referrals to see specialists. They usually have lower out-of-pocket costs but provide limited network coverage.

- Pros: Lower premiums, comprehensive coverage for preventive care.

- Cons: Limited network of healthcare providers, need for referrals to see specialists.

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations, or PPOs, offer more flexibility in choosing healthcare providers without needing referrals. However, they tend to have higher premiums and out-of-pocket costs compared to HMOs.

- Pros: Larger network of providers, no need for referrals to see specialists.

- Cons: Higher premiums and out-of-pocket costs, may require co-payments for services.

High Deductible Health Plans (HDHPs)

High Deductible Health Plans, or HDHPs, have lower premiums but higher deductibles. These plans are often paired with Health Savings Accounts (HSAs) to help individuals save for medical expenses tax-free.

- Pros: Lower premiums, eligibility for HSAs, protection against high medical costs.

- Cons: Higher deductibles, out-of-pocket costs before coverage kicks in.

Coverage and Benefits

Health insurance coverage plays a vital role in ensuring individuals have access to necessary medical care without facing financial burdens. Let's dive into the common coverage and benefits provided by health insurance plans.

Common Health Insurance Coverage

- Preventive Care: Many health insurance plans cover preventive services such as vaccinations, screenings, and annual check-ups to help individuals stay healthy and detect any potential health issues early.

- Hospitalization: Health insurance typically covers the costs associated with hospital stays, surgeries, and other inpatient treatments, relieving individuals from the high expenses of medical procedures.

- Prescription Drugs: Most health insurance plans include coverage for prescription medications, ensuring individuals can afford necessary medications to manage their health conditions.

Deductibles, Copayments, and Coinsurance

In health insurance plans, individuals may encounter terms like deductibles, copayments, and coinsurance, which impact the out-of-pocket costs they are responsible for:

- Deductibles:The amount individuals must pay out of pocket before their insurance starts covering costs.

- Copayments:Fixed amounts individuals pay for covered services, such as doctor visits or prescription drugs.

- Coinsurance:The percentage of costs individuals share with their insurance provider after meeting their deductible.

Additional Benefits in Health Insurance Plans

Some health insurance plans offer additional benefits beyond basic coverage, such as:

- Telemedicine Services: Access to virtual healthcare consultations via phone or video, allowing individuals to seek medical advice conveniently.

- Wellness Programs: Programs that promote healthy behaviors and offer incentives for activities like exercise, nutrition counseling, and smoking cessation.

Understanding Health Insurance Costs

When it comes to health insurance, understanding the costs involved is crucial for making informed decisions. The components of health insurance costs like premiums, deductibles, and out-of-pocket maximums play a significant role in determining the overall expenses.

Breakdown of Health Insurance Costs

- Premiums: The amount you pay for your health insurance coverage, typically on a monthly basis.

- Deductibles: The amount you must pay out of pocket before your insurance starts covering costs.

- Out-of-pocket maximums: The maximum amount you have to pay for covered services in a plan year, after which the insurance pays 100% of covered expenses.

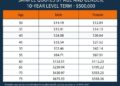

Factors Influencing Health Insurance Costs

Several factors can influence health insurance costs, including:

- Age: Older individuals tend to have higher health insurance premiums.

- Location: Health insurance costs can vary based on where you live due to factors like healthcare provider availability and cost of living.

- Lifestyle: Certain lifestyle habits like smoking or lack of exercise can impact health insurance costs.

Tips for Managing Health Insurance Costs

- Compare Plans: Look at different health insurance plans to find one that offers the coverage you need at a price you can afford.

- Utilize Preventive Care: Taking advantage of preventive services covered by your insurance can help you avoid costly medical expenses down the line.

- Opt for Generic Drugs: Choosing generic medications over brand-name drugs can help save on prescription costs.

- Maintain a Healthy Lifestyle: By staying active, eating well, and avoiding harmful habits, you can potentially reduce your healthcare expenses in the long run.

Closing Summary

In conclusion, exploring Health Insurance (High Intent) unveils a world of possibilities and challenges. By prioritizing your health and financial stability, you can navigate the intricacies of insurance plans with confidence and clarity. Make informed choices to secure a brighter, healthier future.

FAQ Explained

Why is having health insurance important?

Health insurance is crucial as it protects individuals and families from high medical costs and ensures access to necessary healthcare services.

What are the different types of health insurance plans?

Health insurance plans include HMOs, PPOs, and HDHPs, each offering varying coverage, costs, and benefits.

What are deductibles, copayments, and coinsurance in health insurance?

Deductibles are the amount individuals pay before insurance coverage kicks in, while copayments and coinsurance are additional costs shared between the individual and the insurance provider.

How can individuals manage and reduce their health insurance costs?

Managing health insurance costs involves understanding the components like premiums and deductibles, as well as factors like age and location that can influence costs. By exploring cost-saving strategies, individuals can effectively reduce their overall expenses.