Embark on a journey into the realm of Business Insurance, where protection and preparedness are key. Dive into the various types of insurance, factors influencing costs, and the importance of choosing the right policy.

Types of Business Insurance

Business insurance is essential for protecting your company from various risks and liabilities. There are several types of business insurance available, each serving a different purpose. Let's explore some of the most common types:

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. This type of insurance protects your business from lawsuits and legal expenses resulting from accidents or negligence.

Property Insurance

Property insurance covers your business property, including buildings, equipment, inventory, and furniture, from damage or loss due to fire, theft, vandalism, or other covered perils. It helps ensure that your business can recover quickly after a disaster.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects businesses that provide professional services or advice. It covers claims of negligence, errors, or omissions that result in financial loss for clients. This type of insurance is crucial for consultants, lawyers, doctors, and other professionals.

Cyber Insurance

Cyber insurance is becoming increasingly important in today's digital age. It provides coverage for losses related to data breaches, cyberattacks, and other cyber threats. With the rise of cybercrime, businesses need to protect their sensitive information and financial data from hackers and other malicious actors.Overall, having the right mix of business insurance policies can help safeguard your company's financial stability and reputation in the face of unexpected events.

It's important to assess your specific risks and consult with an insurance professional to determine the best insurance coverage for your business.

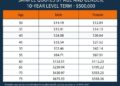

Factors Influencing Business Insurance Costs

When it comes to business insurance costs, several factors come into play that can affect the premiums a company pays. Understanding these key influencers can help businesses make informed decisions when purchasing insurance coverage.

Size and Type of Business

The size and type of business are significant factors that impact insurance costs. Larger businesses with more employees and assets typically face higher risks, leading to higher premiums. Additionally, the type of industry a business operates in can also influence insurance costs.

Industries with higher risks of accidents or lawsuits may have higher premiums compared to low-risk sectors.

Location and Industry Risks

The geographical location of a business plays a crucial role in determining insurance costs. Businesses located in areas prone to natural disasters or high crime rates may face increased premiums due to the elevated risks associated with these locations. Moreover, specific industry risks, such as the potential for product liability claims or workplace injuries, can also impact insurance costs.

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by a business can directly affect insurance premiums. Opting for higher coverage limits or lower deductibles can result in higher premiums since the insurance provider assumes more significant financial responsibility. On the other hand, selecting lower coverage limits or higher deductibles may lead to reduced premiums but could leave the business vulnerable to uncovered losses.

Claims History and Risk Management Practices

A business's claims history and risk management practices are critical factors considered by insurance companies when determining premiums. A track record of frequent or high-cost claims can result in increased premiums as it indicates a higher level of risk. Implementing effective risk management strategies, such as workplace safety programs or regular equipment maintenance, can help mitigate risks and potentially lower insurance costs over time.

Choosing the Right Business Insurance Policy

When it comes to selecting the appropriate insurance coverage for a business, there are several key steps that should be followed to ensure the right protection is in place. One of the first and most crucial steps is conducting a thorough risk assessment to identify potential risks and vulnerabilities that the business may face.

This allows for a tailored insurance policy that addresses the specific needs of the business. Additionally, it is important to regularly review and update insurance policies to guarantee that coverage is adequate and up to date.

Step-by-Step Guide for Selecting Business Insurance

- Assess the Risks: Identify all potential risks and liabilities that your business may face.

- Research Insurance Options: Explore different types of business insurance policies available in the market.

- Consult with an Insurance Professional: Seek advice from an insurance agent or broker to help understand your options.

- Customize Coverage: Tailor the insurance policy to match the specific needs and risks of your business.

- Review Regularly: Periodically review and update your insurance policy to ensure it remains relevant and adequate.

Importance of Conducting a Risk Assessment

Conducting a risk assessment is crucial as it helps businesses identify potential threats and vulnerabilities that could impact their operations. By understanding these risks, businesses can then choose the right insurance coverage to mitigate these risks and protect themselves financially.

Significance of Reviewing and Updating Insurance Policies

Regularly reviewing and updating insurance policies is essential to ensure that coverage remains adequate and up to date. As businesses evolve and grow, their insurance needs may change, making it important to periodically assess and adjust insurance policies accordingly to avoid gaps in coverage.

Claims Process and Handling

When it comes to business insurance, understanding the claims process is crucial for ensuring that your company is adequately protected in the event of unexpected incidents. Knowing how to effectively handle claims can make a significant difference in maximizing your insurance benefits and getting back on track swiftly.

Steps Involved in Filing a Business Insurance Claim

- Notify your insurance provider immediately after the incident occurs to initiate the claims process.

- Gather all necessary documentation, including photos, police reports, and any other relevant evidence to support your claim.

- Complete the claim form provided by your insurance company accurately and provide all requested information.

- Cooperate with the insurance adjuster during the investigation process to assess the damages and determine the extent of coverage.

- Stay informed about the progress of your claim and follow up with your insurance company if necessary.

Insurance Companies Assessment and Payouts Determination

- Insurance companies assess claims based on the terms and conditions Artikeld in your policy to determine coverage eligibility.

- Upon evaluation of the claim, the insurance adjuster will estimate the losses and damages to calculate the payout amount.

- Payouts are typically based on the coverage limits, deductibles, and exclusions specified in your policy.

- Insurance companies aim to settle claims promptly and fairly to help businesses recover from losses efficiently.

Tips for Effective Claims Handling

- Understand your insurance policy coverage and exclusions to ensure you meet all requirements for filing a claim.

- Document all details of the incident, including dates, times, damages, and any other relevant information to support your claim.

- Respond promptly to any requests or inquiries from your insurance company to expedite the claims process.

- Seek guidance from a professional insurance advisor or agent to navigate complex claims and maximize your benefits.

Closing Notes

In conclusion, Business Insurance is a vital shield for businesses in the face of uncertainties. Stay informed, assess risks, and ensure your coverage is up to date to safeguard your venture.

FAQ Guide

What types of business insurance are available?

There are various types such as general liability, property, and professional liability insurance.

How do factors like business size and type influence insurance costs?

The size and type of business can significantly impact insurance costs, with larger businesses typically facing higher premiums.

Why is cyber insurance important for businesses?

Cyber insurance is crucial for protecting businesses against data breaches and cyber threats in the digital age.