Delve into the realm of term life insurance quotes, where financial security meets peace of mind. This guide aims to provide a detailed exploration of the intricacies surrounding term life insurance quotes, offering valuable insights for those seeking protection for the future.

From understanding the basics to navigating the complexities, this guide is your go-to resource for demystifying term life insurance quotes.

Overview of Term Life Insurance Quote

A term life insurance quote is an estimate of the cost of purchasing a specific term life insurance policy. It provides information on the premium amount that an individual would need to pay in order to secure coverage for a set period of time.

Obtaining a term life insurance quote is essential for individuals looking to protect their loved ones financially in the event of their untimely death. It helps individuals assess their insurance needs, compare different policy options, and determine the most cost-effective coverage for their specific requirements.

Types of Term Life Insurance Quotes

- Level Term Insurance:This type of policy offers a fixed premium and death benefit over a specified term, such as 10, 20, or 30 years.

- Decreasing Term Insurance:The death benefit decreases over time, often used to cover a specific debt that decreases over the years, such as a mortgage.

- Convertible Term Insurance:This policy allows the policyholder to convert their term policy into a permanent life insurance policy without undergoing a medical exam.

Factors Influencing Term Life Insurance Quotes

When it comes to determining term life insurance quotes, insurance companies take various factors into account to assess the risk associated with insuring an individual. Understanding these key factors can help individuals make informed decisions when selecting a policy.

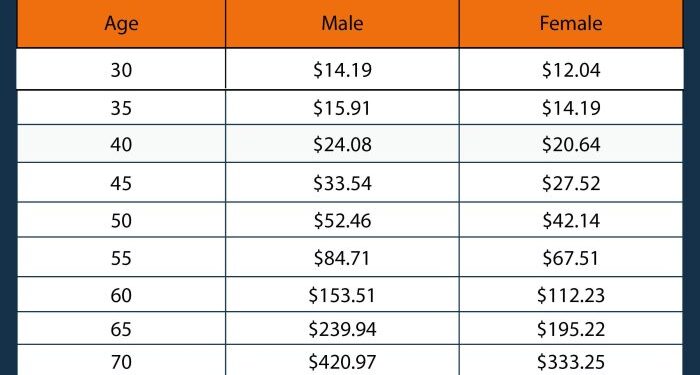

Age and Health

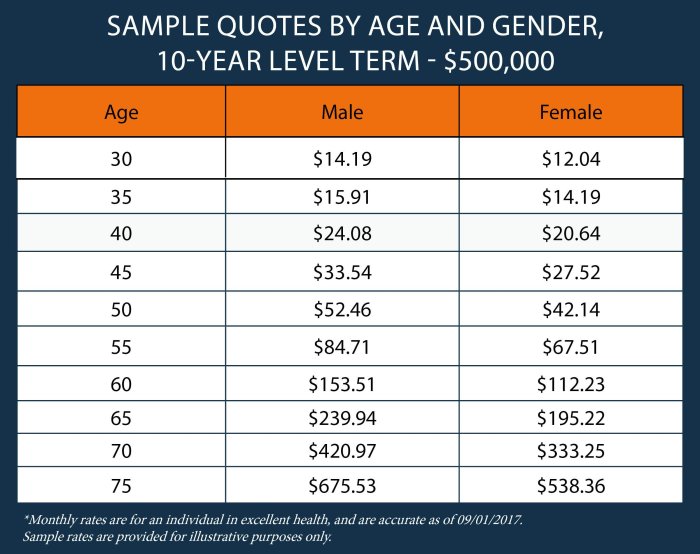

Age and health are two crucial factors that significantly impact term life insurance quotes. Younger individuals who are in good health typically receive lower quotes compared to older individuals or those with pre-existing medical conditions. This is because younger and healthier individuals are considered lower risk by insurance companies, leading to lower premiums.

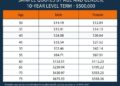

Coverage Amount and Term Length

The coverage amount and term length chosen also play a significant role in determining the cost of a term life insurance quote. Generally, higher coverage amounts and longer terms lead to higher premiums. This is because the insurance company is taking on a greater risk by providing a larger benefit amount for a longer period.

Individuals should carefully consider their financial needs and goals when selecting the coverage amount and term length to ensure they are adequately protected without overpaying for unnecessary coverage.

Obtaining a Term Life Insurance Quote

When it comes to obtaining a term life insurance quote, there are a few key steps to keep in mind. It is essential to provide accurate information to ensure that the quote you receive is as precise as possible. Additionally, you have the option to use online tools or speak directly with an insurance agent to obtain quotes.

Importance of Providing Accurate Information

Providing accurate information when requesting a term life insurance quote is crucial. Insurance companies use the information you provide to assess the level of risk associated with insuring you. Inaccurate information could lead to discrepancies in the quote you receive, potentially resulting in higher premiums or even denial of coverage.

- Be truthful about your health history, lifestyle habits, and any pre-existing conditions.

- Ensure all personal information, such as age and occupation, is correct.

- Include accurate details about the coverage amount and term length you are seeking.

Online Quote Tools vs. Speaking with an Insurance Agent

When it comes to obtaining a term life insurance quote, you have the option to use online tools or speak directly with an insurance agent. Both methods have their advantages and considerations.

- Online Quote Tools:Online tools offer convenience and speed, allowing you to input your information and receive a quote instantly. However, these tools may not capture all relevant details, and you may have limited options for customization.

- Speaking with an Insurance Agent:Speaking with an insurance agent allows for a more personalized experience. An agent can help guide you through the process, answer any questions you may have, and provide tailored recommendations based on your individual needs. However, this method may take longer than using online tools.

Understanding and Comparing Term Life Insurance Quotes

When it comes to term life insurance, understanding and comparing quotes is crucial to finding the right coverage for your needs. Here we will discuss how to interpret a term life insurance quote, provide tips on comparing quotes from different insurance providers, and emphasize the importance of reading the fine print and understanding policy details.

Interpreting a Term Life Insurance Quote

When looking at a term life insurance quote, pay attention to the coverage amount, premium cost, term length, and any additional riders or benefits included. The coverage amount is the sum of money your beneficiaries will receive upon your death.

The premium cost is the amount you will pay periodically for the coverage. The term length specifies how long the coverage will last.

Tips for Comparing Quotes

- Compare coverage amounts: Make sure you are comparing quotes for the same coverage amount to get an accurate comparison.

- Consider premium costs: Look at the premium costs for each quote and determine which one fits your budget.

- Check for riders and benefits: See if there are any additional riders or benefits included in the quotes that could enhance your coverage.

Reading the Fine Print and Understanding Policy Details

It is essential to read the fine print of each term life insurance quote to understand any exclusions, limitations, or conditions that may apply. Pay attention to the renewal options, conversion opportunities, and any potential changes to premiums over time.

Understanding these policy details will help you make an informed decision when selecting the right term life insurance policy.

Last Word

In conclusion, term life insurance quotes serve as a crucial tool in safeguarding your loved ones' financial well-being. By grasping the nuances of obtaining and comparing quotes, you pave the way for a secure future. Empower yourself with knowledge and make informed decisions to protect what matters most.

FAQ Guide

What factors can influence the cost of a term life insurance quote?

Factors such as age, health condition, coverage amount, and term length are key considerations that insurance companies take into account when providing a quote.

Is it better to use online quote tools or speak with an insurance agent for obtaining term life insurance quotes?

Online quote tools offer convenience and speed, while speaking with an agent allows for personalized guidance. The choice depends on individual preferences and needs.

How can one effectively compare term life insurance quotes from different providers?

Comparing quotes involves looking beyond the surface numbers and understanding the coverage details, exclusions, and any additional benefits offered by each provider.