Life Insurance (High Intent) sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From the importance of financial planning to the various types of policies available, this topic delves into the intricate world of life insurance with a focus on providing security and peace of mind for you and your loved ones.

Importance of Life Insurance

Life insurance plays a crucial role in financial planning by providing a safety net for unforeseen circumstances. It offers financial security and peace of mind to individuals and their loved ones in times of need.

Financial Security for Loved Ones

Life insurance ensures that in the event of the policyholder's death, their loved ones are financially protected. The death benefit received can cover expenses such as mortgage payments, education costs, and daily living expenses. This financial security can help ease the burden on family members during a difficult time.

Peace of Mind

Having life insurance brings peace of mind to policyholders, knowing that their loved ones will be taken care of financially. It eliminates worries about leaving behind financial responsibilities and ensures that the family's financial future is secure. Additionally, life insurance can provide funds for final expenses, relieving stress from grieving family members.

Types of Life Insurance Policies

Term life and whole life insurance are two common types of life insurance policies. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If the policyholder passes away during the term, their beneficiaries receive a death benefit.

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual. It also includes a cash value component that grows over time.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers more flexibility compared to whole life insurance. It allows policyholders to adjust their premium payments and death benefits. The cash value of a universal life insurance policy earns interest based on current market rates, which can help offset premiums or increase the death benefit.

Variable Life Insurance

Variable life insurance is another type of permanent life insurance that combines a death benefit with an investment component. Policyholders have the option to allocate their premiums among different investment options, such as stocks, bonds, or mutual funds. The cash value and death benefit of a variable life insurance policy can fluctuate based on the performance of the underlying investments.

Factors to Consider When Choosing Life Insurance

When selecting a life insurance policy, there are several important factors to take into consideration to ensure you choose the right coverage for your needs.

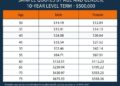

Impact of Age and Health on Premiums

Age and health are two key factors that greatly impact life insurance premiums. Younger individuals who are in good health typically pay lower premiums compared to older individuals or those with pre-existing medical conditions. Insurance companies assess the risk of insuring an individual based on their age and health status, so it's essential to consider these factors when choosing a policy.

Importance of Coverage Amount and Duration

The coverage amount and duration of a life insurance policy are crucial aspects to consider. The coverage amount should be sufficient to provide financial support to your beneficiaries in the event of your passing. Additionally, the duration of the policy should align with your financial obligations and the needs of your loved ones.

It's important to carefully evaluate how much coverage you need and for how long to ensure your policy adequately protects your family.

Selecting Beneficiaries

Choosing the right beneficiaries for your life insurance policy is another critical decision. Beneficiaries are the individuals who will receive the death benefit upon your passing. It's essential to designate beneficiaries who are financially dependent on you or who would benefit from the proceeds of the policy.

Consider the needs of your loved ones and how the death benefit can best support them financially.

Life Insurance Riders and Add-Ons

Life insurance riders and add-ons are additional features that policyholders can include in their life insurance policies to enhance coverage and customize their protection according to their specific needs.

Accidental Death and Waiver of Premium Riders

- Accidental Death Rider: This rider provides an additional payout to the beneficiary if the insured dies as a result of an accident. It offers extra financial protection in case of unexpected and tragic events.

- Waiver of Premium Rider: With this rider, if the policyholder becomes disabled and unable to work, the insurance company waives the premium payments while keeping the policy in force. It ensures that the coverage continues even during times of financial hardship.

Critical Illness Riders

- Critical Illness Rider: This rider provides a lump sum payment if the insured is diagnosed with a covered critical illness such as cancer, heart attack, or stroke. It offers financial support to cover medical expenses and other costs associated with the illness.

- Benefits: Critical illness riders can help policyholders cope with the financial impact of a serious illness, allowing them to focus on recovery without worrying about the financial burden. It provides an extra layer of protection beyond traditional life insurance coverage.

Long-Term Care Riders

- Long-Term Care Rider: This rider allows policyholders to access a portion of the death benefit to cover long-term care expenses if they become chronically ill or unable to perform daily activities independently.

- Benefits: Long-term care riders provide policyholders with the flexibility to use their life insurance benefits for long-term care needs, helping them maintain their quality of life without depleting their savings. It offers a comprehensive approach to financial planning for potential health challenges in the future.

Life Insurance Application Process

When applying for life insurance, there are several important steps to follow to ensure you get the right coverage for your needs. Understanding the application process can help you make informed decisions and secure your financial future.

Importance of Medical Exams and Underwriting

Medical exams and underwriting play a crucial role in the life insurance application process. Insurers use this information to assess your health status, lifestyle habits, and other risk factors that may affect your coverage and premiums. It is essential to be honest and thorough during this process to avoid any discrepancies that could lead to claim denials in the future.

- Medical Exams: Insurers may require you to undergo a medical exam to evaluate your overall health. This may include blood tests, urine samples, and physical examinations to determine any pre-existing conditions or health risks.

- Underwriting: Underwriting involves assessing the information gathered from the medical exams and application forms to determine the level of risk you pose as an insured individual. Based on this evaluation, the insurer will decide on your coverage options and premium rates.

How to Review and Compare Life Insurance Quotes Effectively

Reviewing and comparing life insurance quotes is crucial to finding the best policy that meets your needs and budget. Here are some tips on how to effectively review and compare quotes:

- Consider Coverage Options: Evaluate the different types of life insurance policies available, such as term life, whole life, or universal life, to determine which one aligns with your financial goals.

- Compare Premium Rates: Request quotes from multiple insurers and compare the premium rates offered for the same coverage amount. Look for any additional fees or discounts that may impact the overall cost.

- Assess Riders and Add-Ons: Review the riders and add-ons available with each policy to see if they provide additional benefits or customization options that suit your needs.

- Check Financial Strength: Research the financial stability and reputation of the insurance company to ensure they can fulfill their obligations in the long run. Look for ratings from independent agencies like A.M. Best or Moody's.

Final Review

In conclusion, Life Insurance (High Intent) serves as a vital tool in safeguarding your financial future and ensuring that your loved ones are protected. By understanding the different policy options, considering key factors, and exploring additional riders and add-ons, you can make informed decisions to secure a stable financial foundation.

Clarifying Questions

How does age impact life insurance premiums?

Age is a significant factor in determining life insurance premiums, with younger individuals typically paying lower premiums compared to older individuals.

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance covers you for your entire life and includes a cash value component.

Why are medical exams important in the life insurance application process?

Medical exams help insurance companies assess your health risks and determine appropriate premiums for your policy.

What are common riders in life insurance policies?

Common riders include accidental death, waiver of premium, and critical illness riders, which enhance your coverage based on specific needs.