When it comes to finding affordable auto insurance, the key is in understanding the factors that influence quotes and the strategies to obtain the best deal. Dive into this comprehensive guide to discover how you can save on your auto insurance costs.

From comparing quotes effectively to leveraging technology for personalized solutions, this discussion covers it all. So, let's unravel the world of cheap auto insurance quotes together.

Factors affecting the cost of auto insurance quotes

When it comes to determining the cost of auto insurance quotes, several key factors come into play. These factors can significantly impact the final price you pay for your insurance coverage.

Demographics

Demographic factors such as age, gender, marital status, and even credit score can influence the cost of auto insurance quotes. Younger drivers, especially teenagers, tend to pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Driving Record

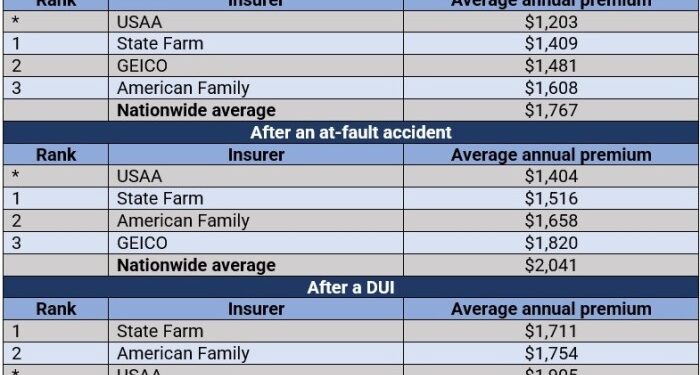

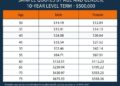

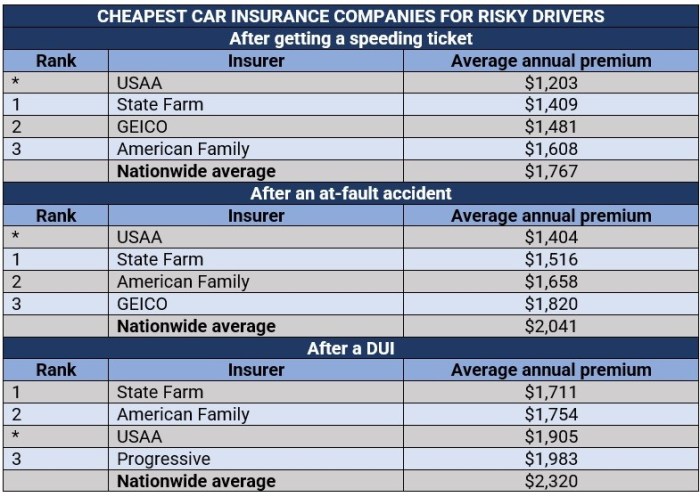

Your driving record plays a crucial role in determining your auto insurance rates. Drivers with a history of accidents, traffic violations, or DUIs are considered high-risk and are likely to face higher insurance premiums. On the other hand, a clean driving record can lead to lower quotes.

Location

Where you live can also impact the cost of your auto insurance. Urban areas with higher traffic congestion and crime rates tend to have higher insurance premiums compared to rural areas. Additionally, states with no-fault insurance laws may have higher premiums due to the increased likelihood of claims.

Type of Vehicle

The make and model of your vehicle can affect your insurance rates. Expensive cars, sports cars, and vehicles with high theft rates may result in higher premiums. On the other hand, safety features, anti-theft devices, and vehicles with good crash test ratings can lead to lower insurance costs.

Bundling Policies and Deductibles

One way to potentially lower your auto insurance quotes is by bundling multiple policies, such as auto and home insurance, with the same provider. This can often result in discounts on both policies. Additionally, choosing a higher deductible means you'll pay more out of pocket in the event of a claim, but it can lead to lower monthly premiums.

Strategies for obtaining affordable auto insurance quotes

When looking for affordable auto insurance quotes, there are several strategies you can use to ensure you get the best deal possible.

Comparing quotes effectively

One of the key strategies to obtain affordable auto insurance quotes is to compare quotes from different insurance providers effectively. Make sure to gather quotes from multiple companies and compare coverage options, deductibles, and discounts offered to find the best value for your money.

Maintaining a good credit score

Having a good credit score can significantly impact your auto insurance rates. Insurance companies often use credit scores as a factor in determining premiums, so maintaining a good credit score can help you access cheaper insurance rates.

Shopping around and negotiating

It's essential to shop around and negotiate with insurance providers to secure the best possible deal. Don't be afraid to ask for discounts or explore different coverage options to find a policy that meets your needs while staying within your budget.

Understanding the coverage options in cheap auto insurance quotes

When looking for affordable auto insurance, it's crucial to understand the different coverage options available to you. Each type of coverage offers different levels of protection, and knowing what they entail can help you make informed decisions about your policy.Liability Coverage:Liability coverage is typically included in most affordable auto insurance quotes and is mandatory in most states.

This coverage helps pay for the other party's medical expenses and property damage if you're at fault in an accident

While it's not always required, adding comprehensive coverage to your policy can provide extra peace of mind.Collision Coverage:Collision coverage helps pay for damages to your vehicle in the event of a collision with another vehicle or object. This coverage is often included in cheap auto insurance quotes, but you can adjust the deductible to lower your premium.Uninsured/Underinsured Coverage:Uninsured/underinsured coverage protects you if you're involved in an accident with a driver who doesn't have insurance or enough coverage to pay for damages.

While not always mandatory, adding this coverage can be beneficial in case of an accident.By understanding the coverage options included in cheap auto insurance quotes, you can tailor your policy to fit your needs while keeping costs low.

Utilizing technology to find cheap auto insurance quotes

In today's digital age, technology plays a crucial role in helping consumers find affordable auto insurance quotes. Online comparison tools and apps have revolutionized the way people shop for insurance, making it easier to compare prices and coverage options from multiple providers within minutes.

Additionally, telematics devices and usage-based insurance have emerged as innovative solutions to lower insurance premiums by tracking driving habits and rewarding safe drivers. By leveraging technology, individuals can access personalized and cost-effective insurance solutions tailored to their specific needs.

Online Comparison Tools and Apps

Online comparison tools and apps allow consumers to input their information once and receive quotes from various insurance companies instantly. These platforms streamline the process of comparing prices, coverage options, and discounts, enabling users to make informed decisions based on their budget and preferences.

Telematics Devices and Usage-Based Insurance

Telematics devices, such as plug-in devices or mobile apps, monitor driving behavior, including speed, mileage, and braking patterns. Insurers use this data to calculate premiums based on individual driving habits, incentivizing safe driving practices and potentially lowering insurance costs for policyholders who exhibit low-risk behavior.

Personalized and Cost-Effective Solutions

By embracing technology, insurance companies can offer personalized solutions that cater to the unique needs of each customer. Through data analysis and predictive modeling, insurers can tailor coverage options, deductibles, and discounts to provide cost-effective policies that align with the policyholder's driving habits and risk profile.

This personalized approach not only enhances the customer experience but also ensures that individuals receive the most competitive rates available in the market.

Final Summary

In conclusion, navigating the realm of cheap auto insurance quotes doesn't have to be daunting. By applying the strategies and understanding the coverage options Artikeld here, you can secure a cost-effective insurance plan tailored to your needs. Start saving on your auto insurance today!

Frequently Asked Questions

What factors can impact the cost of cheap auto insurance quotes?

Factors like demographics, driving record, location, and the type of vehicle can all influence the pricing of auto insurance quotes.

How can I obtain affordable auto insurance quotes?

You can compare quotes effectively, maintain a good credit score, and shop around to secure the best possible deal.

What coverage options are typically included in cheap auto insurance quotes?

Coverage options may include liability, comprehensive, collision, and uninsured/underinsured coverage. Adding or removing specific coverage types can impact the overall cost.

How can technology help in finding cheap auto insurance quotes?

Online comparison tools, apps, and telematics devices play a crucial role in finding the best deals and lowering insurance premiums.